goodzonemedia.ru

Gainers & Losers

Carbon Offset Brokers

3Degrees develops carbon offset projects that are third-party verified and registered under one of the internationally-recognized carbon offset standards. Your. Read articles from Respira International to learn about the voluntary carbon market, carbon credits and our company news. Our brokerage has access to the world's best projects and prices through partnerships with offset project developers. Bring us your demands. Your Partner for Seamless Carbon Trading and Compliance Procurement · Cost-Efficient, Strategy-Based Trading · Covering All Bases · Unrivalled Environmental. More experienced buyers may prefer to work directly with a project developer through an over-the-counter transaction, while newer buyers will let a broker or. Anyone can purchase these units on this platform to compensate (or offset) emissions and/or to support these projects. They can be used by individuals. Brokers procure offset credits and then transfer (or retire) them on clients' behalf. Brokers can make it easier to identify a mix of offset credits from. Carbon offsetting is a carbon trading mechanism that enables entities to compensate for offset greenhouse gas emissions by investing in projects that reduce. Our experience in carbon markets is deep and our brokers are the markets' most experienced. We advise clients on market developments and risk management. 3Degrees develops carbon offset projects that are third-party verified and registered under one of the internationally-recognized carbon offset standards. Your. Read articles from Respira International to learn about the voluntary carbon market, carbon credits and our company news. Our brokerage has access to the world's best projects and prices through partnerships with offset project developers. Bring us your demands. Your Partner for Seamless Carbon Trading and Compliance Procurement · Cost-Efficient, Strategy-Based Trading · Covering All Bases · Unrivalled Environmental. More experienced buyers may prefer to work directly with a project developer through an over-the-counter transaction, while newer buyers will let a broker or. Anyone can purchase these units on this platform to compensate (or offset) emissions and/or to support these projects. They can be used by individuals. Brokers procure offset credits and then transfer (or retire) them on clients' behalf. Brokers can make it easier to identify a mix of offset credits from. Carbon offsetting is a carbon trading mechanism that enables entities to compensate for offset greenhouse gas emissions by investing in projects that reduce. Our experience in carbon markets is deep and our brokers are the markets' most experienced. We advise clients on market developments and risk management.

Looking for high quality carbon credits? Wanting to offset carbons and help the environment? Terrapass is the world's leading carbon platform for you! BROKERS/CONSULTANTS · Determine timely carbon market price ranges when assisting clients with transactions. · Leverage market insight when conducting cost. A short answer would be that the UN Carbon Offset Platform is an e-commerce platform where a company, an organization or a regular citizen can purchase. We are a leading carbon credit investment company financing high-quality carbon credit projects globally. Invest with us. Through our carbon offsetting brokerage, we deliver guidance on how to offset emissions through strong carbon offsetting policies. Carbon offsetting is the process of funding projects that reduce or remove greenhouse gas emissions to compensate for one's own emissions, in order to. Carbon Trade eXchange (CTX) is the world's first digital carbon offsetting exchange for spot price, voluntary carbon credit trading. Oversight of Carbon Emissions Trading · Ghost credits are purchasable offsets that are not genuine carbon offsets. · Wash trading is manipulating a commodity to. Whether you want to reduce your organization's carbon footprint, generate a new revenue stream through carbon credit sales, or engage stakeholders by. Carbon offset brokers can start a conversation to learn about partnering with how Native for carbon offset inventory and procurement. Community about trading, buying, selling, discussing and discovering opportunities in carbon credits and carbon offsets markets. Show more. Carbon Market Actors. Brokers and Exchanges. In the carbon credit wholesale market, emission credit buyers and sellers can have transactions facilitated by. Name: Mr. Nathan Dale ; Title: ; Email: [email protected] ; Phone: () We are a leading carbon credit investment company financing high-quality carbon credit projects globally. Invest with us. Evolution Markets brokers have been named the best carbon broker for the EU Emissions Trading Scheme, California, and the Regional Greenhouse Gas Initiative . Obtain fair-market value for offset credits acquired in the OTC market. BROKERS/CONSULTANTS. Determine timely carbon market price ranges when assisting clients. The database, developed by the Berkeley Carbon Trading Project, contains all carbon offset projects, credit issuances, and credit retirements listed globally. Whether you call them "carbon credits" or "carbon offsets", certified cuts in greenhouse gases are key to helping organisations finance and scale planet-saving. When considering purchasing carbon offsets, buyers need to proceed carefully and assess whether offset vendors (whether brokers, retailers, or the offset.

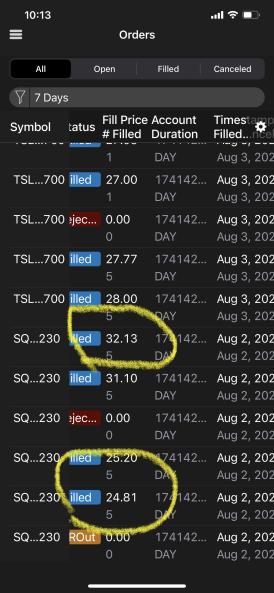

Setting Up A Day Trading Account

A common approach for new day traders is to start with a goal of $ per day and work up to $$ over time. Small winners are better than home runs. Hi all, So I've been doing a lot of day trading US Options and some ASX shares almost every day especially this start of the new FY I do it to gain. Start by paper trading as others say, and once you start to get a feel for it, join a prop firm like Apex(there are several firms to choose from). Learn the Basics · Get a Fast and Reliable Trading Computer · Setting up a Trading Account · Choosing a Day Trading Strategy · How to Analyze Stocks and Setup Your. Starting a day trading business is very simple. All it takes is applying with a brokerage and loading money into your trading account. Day trading guide for beginners · 1. Learn the basics of the stock market · 2. Choose a broker · 3. Set up a demo account · 4. Develop a trading strategy · 5. Start. And traders will likely find OptionStation Pro a valuable tool for setting up trades and visualizing the potential payoffs. How do I open a brokerage account? Day traders must be prepared and able to set aside the time needed to manage trading positions in fast moving markets. Consider using a demo account and. When you set up a legal trading entity, the mere act of setting up the entity tells the IRS that you are going into the active trading business. With that being. A common approach for new day traders is to start with a goal of $ per day and work up to $$ over time. Small winners are better than home runs. Hi all, So I've been doing a lot of day trading US Options and some ASX shares almost every day especially this start of the new FY I do it to gain. Start by paper trading as others say, and once you start to get a feel for it, join a prop firm like Apex(there are several firms to choose from). Learn the Basics · Get a Fast and Reliable Trading Computer · Setting up a Trading Account · Choosing a Day Trading Strategy · How to Analyze Stocks and Setup Your. Starting a day trading business is very simple. All it takes is applying with a brokerage and loading money into your trading account. Day trading guide for beginners · 1. Learn the basics of the stock market · 2. Choose a broker · 3. Set up a demo account · 4. Develop a trading strategy · 5. Start. And traders will likely find OptionStation Pro a valuable tool for setting up trades and visualizing the potential payoffs. How do I open a brokerage account? Day traders must be prepared and able to set aside the time needed to manage trading positions in fast moving markets. Consider using a demo account and. When you set up a legal trading entity, the mere act of setting up the entity tells the IRS that you are going into the active trading business. With that being.

ed day trading training to such customer before opening the account, the broker-dealer could designate that customer as a pattern day trader. What is a “day. To start day trading, choose an amount of money to invest and select a trading platform. If you're new to stock markets in general, it may benefit you to work. To start in day trading is relatively easy, all you need is real-time market data, a broker, and a scanner or screener (and money of course). Nowadays you can. How to day trade · Open an account. A live account will grant you automatic access to a demo account, where you can practise with virtual funds. · Choose your. First, pattern day traders must maintain minimum equity of $25, in their margin account on any day that the customer day trades. This required minimum equity. Starting a day trading business is very simple. All it takes is applying with a brokerage and loading money into your trading account. It's because of your transaction costs. Let me prove it to you with very simple math. Let's assume that you have a $ trading account. Let's say every time. Statistics say that 90% of traders blow up their accounts in the first 3 months of trading. Because of that, being a day trader can be considered as one of. Pattern day traders must adhere to specific margin requirements, notably maintaining a minimum equity of $25, in their trading account before engaging in day. To start day trading, you may consider choosing an instrument you want to trade (for example via derivative products); then open a brokerage account, and design. Choose an online broker, also known as a discount brokerage, based on criteria that's important to you. · Open an account. · Read up on different trading. You start with zero shares of ABC stock and then: Buy 1 ABC; Sell 1 ABC. This counts as 1 day trade because you bought and sold ABC in the same trading day. The recommendation is that you risk a maximum of two percent of your account per trade. When trading with just $1, and starting out as a trader, avoid. Fees & Payments – If you are considered a pattern day trader in the US, you will need to maintain an equity balance of $25, Brokers will set their own. Once an account is coded as a Pattern Day Trader, total account equity needs to be maintained at above $25, in order to day trade. If the equity falls below. Do your research on day trading – you can access our countless resources with research-based content for free · Create a tastytrade account or log in (learn more. It's generally recommended that traders start with at least $25, in their brokerage accounts before day trading. Are there any specific timeframes or. The first step to start day trading on E*TRADE is to open a dedicated day trading account, ensuring compliance with regulations such as the pattern day trader. Begin opening an account. You typically start the process by navigating to the website of your chosen day trading platform and clicking "Open Account." Enter. After deepening your knowledge of strategies and the market factors that impact day trading, it's time to open a trading account and start trading on live.