goodzonemedia.ru

Prices

Best 12 Month Investment

As the underlying tenure is very short-term in nature, the best way to invest is to create an FD, which will allow you to protect your money. Earn More with our Promotional Rates. %. Annual Percentage Yield (APY). for a 4 month 12, 18, 24, 36, and 60 months) that is closest to but not. We've compared CD accounts at 84 nationally available banks and credit unions to find some of the best one-year certificates available. A one-year term deposit could be a good choice for someone looking to safely invest their money and get a decent return on it. Before committing your money to a. TD offers a wide range of GICs and Term Deposits, so you can easily choose the one that best meets your investing goals. 12 Month. %. 12 Month. %. 12 Month. %. 12 Month. %. 24 Month. Good news, you can use your Frost Savings Account or Frost Money Market. The lowest month return was % (March to March ). Savings accounts at a financial institution may pay as little as % or less but carry. % (trailing 12 months). Prime Rate. Prime Rate: Displays the Prime Rate. % (effective 07/27/). FDIC Insured Bank Deposit Rates (Effective 03/23/). CDs: a rundown ; %, 3 months, $10, ; %, 12 months, $1, As the underlying tenure is very short-term in nature, the best way to invest is to create an FD, which will allow you to protect your money. Earn More with our Promotional Rates. %. Annual Percentage Yield (APY). for a 4 month 12, 18, 24, 36, and 60 months) that is closest to but not. We've compared CD accounts at 84 nationally available banks and credit unions to find some of the best one-year certificates available. A one-year term deposit could be a good choice for someone looking to safely invest their money and get a decent return on it. Before committing your money to a. TD offers a wide range of GICs and Term Deposits, so you can easily choose the one that best meets your investing goals. 12 Month. %. 12 Month. %. 12 Month. %. 12 Month. %. 24 Month. Good news, you can use your Frost Savings Account or Frost Money Market. The lowest month return was % (March to March ). Savings accounts at a financial institution may pay as little as % or less but carry. % (trailing 12 months). Prime Rate. Prime Rate: Displays the Prime Rate. % (effective 07/27/). FDIC Insured Bank Deposit Rates (Effective 03/23/). CDs: a rundown ; %, 3 months, $10, ; %, 12 months, $1,

Pick the length of time that works best for your savings needs or goals Over 12 months through 24 months, the penalty is 6 months' interest, or; Over. New Issue CD Rates (% APY) ; 1-Year Ladder. (4 CDs). 3 mo. 6 mo ; 2-Year Ladder. (4 CDs). 6 mo. 12 mo ; 5-Year Ladder. (5 CDs). 1 yr. best interests of the Fund. An investment in the Schwab Money Funds is not *The annual percentage yield (APY) displayed includes 3-month to 1-year values. Truist Certificate of Deposit (CD) Earn special rates on select new CD accounts: % annual percentage yield (APY) on a 5-month CD. Or % APY on a Certificates of deposit (CDs) can be a good choice when you want steady, predictable investment income that is federally insured. We compared GICs at 43 financial institutions to find some of the best options available. Learn more about why we picked each GIC, the pros and cons and. Mountain America's certificates are a great way to earn competitive dividends on safe, long-term investments. month, % (% APY), % (% APY). At maturity, Fixed Term CDs renew into Fixed Term CDs of the same term length unless you make a change during the 7-day grace period. At maturity, a 12 Month. You connect with our advisors via video or phone to find the program investment strategy that fits you best. revenue credit in a month period. A small. Benefit from a fixed interest rate - just choose which term suits you. Choose from a 6, 12, or month Online CD and benefit from fixed interest rates. Short-term deposit investors can find a great rate on our list of the best 3-month CDs. Best savings accounts of April Banking · Best savings accounts. Best Short-Term Investment Options for 3 Months · Recurring Deposits · Bank Fixed Deposits · Treasury Securities · Money Market Account · Stock Market /Derivatives. Find a U.S. Bank CD (certificate of deposit) that best suits your investing needs, with the CD rate and term that is right for you. Apply now. month fixed deposit savings account When it's important to you, you take the time and focus on what's best. Our month fixed deposit gives your savings. Best 3-Month Jumbo CDs, Rate, Term, Minimum. CD Bank, % APY, 3 months 12 months & 15 months, $,, All earned interest (6 months maximum). All In. Up to % APY* with a 3 to Month New Money CD. Your funds will National deposit rates for a 3, 6 and month CD are %, % and 12 CFR (a)(2) "collective investment fund." Dollar-weighted Average Join one of the best places to work. OCC Logo · goodzonemedia.ru Visit the official. If, for example, you're buying shares, making regular monthly purchases can help to smooth out market returns because your fixed monthly investment effectively. 12 Month. Earn up to. Relationship APY2. Secure Open account. 18 Month. Earn up With a $ minimum investment requirement, you can start building your. You can transfer funds from another plan to your ScholarShare account for the same beneficiary once within a month period without incurring tax.

Property Cash Out Plan

When home values soar, real estate investors may want to cash out the equity they've built up. Cash-out refinancing on investment properties can help you pay. Like any other mortgage loan, a borrower needs to meet certain criteria set by their lender to qualify for a cash-out refinance. Lenders set a home equity. Cash out refinancing (in the case of real property) occurs when a loan is taken out on property already owned in an amount above the cost of transaction. However, you can tap into your home equity without having to move. A cash-out refinance replaces your old mortgage with a new, larger loan. You pocket the. You also need to have a clear idea of how you'll use the money you free up when you refinance. This is particularly true if you plan on cashing out your equity. A cash-out refinance is when you borrow more money than you owe on your existing mortgage, taking out a larger mortgage at a new loan amount. With a cash out refinance, you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, if. For example, if your house is worth $, and you owe $, on your existing mortgage, you have $, in available equity. Keeping the maximum 80% LTV. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow Whether your borrowers rent, own, or plan to buy. When home values soar, real estate investors may want to cash out the equity they've built up. Cash-out refinancing on investment properties can help you pay. Like any other mortgage loan, a borrower needs to meet certain criteria set by their lender to qualify for a cash-out refinance. Lenders set a home equity. Cash out refinancing (in the case of real property) occurs when a loan is taken out on property already owned in an amount above the cost of transaction. However, you can tap into your home equity without having to move. A cash-out refinance replaces your old mortgage with a new, larger loan. You pocket the. You also need to have a clear idea of how you'll use the money you free up when you refinance. This is particularly true if you plan on cashing out your equity. A cash-out refinance is when you borrow more money than you owe on your existing mortgage, taking out a larger mortgage at a new loan amount. With a cash out refinance, you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, if. For example, if your house is worth $, and you owe $, on your existing mortgage, you have $, in available equity. Keeping the maximum 80% LTV. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow Whether your borrowers rent, own, or plan to buy.

Improving your home can be expensive. Cash-out refinances can provide funding for renovations or remodeling projects using the equity in your home. Home. An FHA cash-out refinance is an FHA loan option that allows you to borrow more than you currently owe and pocket the difference between the two loans in cash. Cash-out refinancing is a refinancing option that allows the borrower to receive money by taking out a larger mortgage on their property than their current. A smart cash-out refinancing could open the door to a bright future. Put yourself in control by turning some of the equity you've built in your home into cash. Cash-out refinance pays off your existing first mortgage. This results in a new mortgage loan which may have different terms than your original loan. A cash out refinance is a type of mortgage that allows you to borrow against the equity in your home. This can be used for a variety of purposes, such as home. Cash-Out Refinancing works by allowing you to turn part (or all, in some instances) of your home's equity into liquid cash. Your home equity is your home's. With a cash-out refinance, you pay off your current mortgage and create a new one, allowing you to keep part of your home's equity as cash to pay for the. The FHA cash-out refinance option allows homeowners to pay off their existing mortgage, and create a larger home loan that provides them with extra cash. The Department of Veterans Affairs (VA) Cash-Out Refinance Loan is for homeowners who want to trade equity for cash from their home. Using a cash-out refinance to consolidate debt increases your mortgage debt, reduces equity, and extends the term on shorter-term debt and secures such debts. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow Whether your borrowers rent, own, or plan to buy. Cash-out refinancing lets you take advantage of the equity built up on your rental property owned within your self-directed IRA. Speak with our non-recourse. Cash-out refinancing is when you leverage your home's equity to borrow more money than is owed on your existing mortgage and receive the difference in cash. You. Unlock the equity in your home to access cash that can be used to finance major purchases, home renovations or pay off other debt. Get expert advice from a name. Overall, a cash-out refinance is a great way to access the equity you've built in your home to get the money you need to achieve your goals. If you're looking. A cash-out refinance can allow you to borrow from the equity you've built in your home and receive cash that can be used for just about anything. A cash-out refinance is a new mortgage (replacing your old one) that lets you borrow extra money as part of the mortgage. A fixed home equity loan is a loan. Commercial cash-out refinancing occurs in situations when real estate investors decide to avail a new loan on an existing property to extract the equity of the.

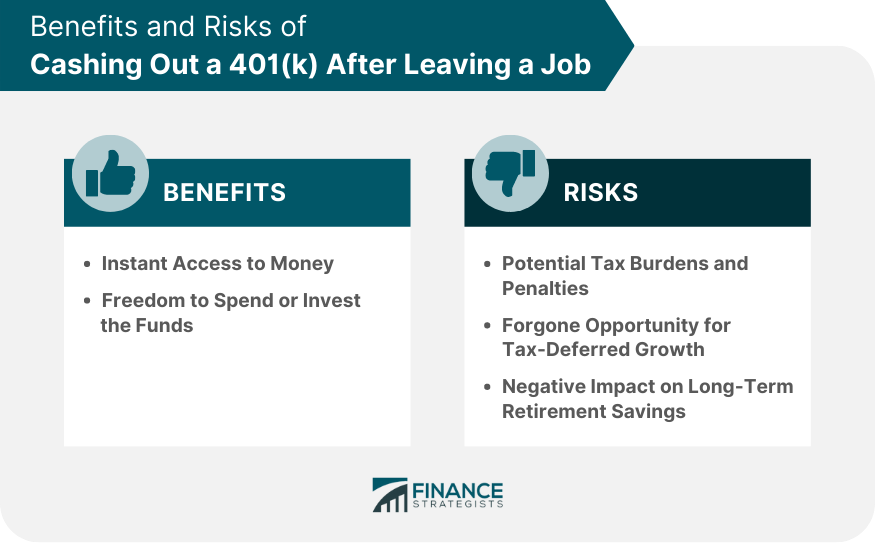

401k After Leaving Employer

1. Leave it in your current (k) plan. The pros: If your former employer allows it, you can. Options For a (a) After Leaving an Employer If you have a (a) with your existing employer and you leave that job, you can either keep the funds in the. Once you leave a job where you have a (k), you can no longer make contributions to the plan and no longer receive the match. There may be better investment. Even after leaving a job, companies will often continue mailing out quarterly or yearly statements to participants on the status of their account. You can. If your (k) or (b) balance has less than $1, vested in it when you leave, your former employer can cash out your account or roll it into an individual. You can cash out your entire retirement plan balance when you leave an employer. But that could have a major impact on your savings—and your retirement. You generally have three other options for handling your (k) when you leave your job: You can leave the funds in your former employer's plan (if permitted). Key Takeaways · If you leave your job, you can still maintain your Roth (k) account with your old employer. · Under some circumstances, you can transfer your. A direct (k) rollover gives you the option to transfer funds from your old plan directly into your new employer's (k) plan without incurring taxes or. 1. Leave it in your current (k) plan. The pros: If your former employer allows it, you can. Options For a (a) After Leaving an Employer If you have a (a) with your existing employer and you leave that job, you can either keep the funds in the. Once you leave a job where you have a (k), you can no longer make contributions to the plan and no longer receive the match. There may be better investment. Even after leaving a job, companies will often continue mailing out quarterly or yearly statements to participants on the status of their account. You can. If your (k) or (b) balance has less than $1, vested in it when you leave, your former employer can cash out your account or roll it into an individual. You can cash out your entire retirement plan balance when you leave an employer. But that could have a major impact on your savings—and your retirement. You generally have three other options for handling your (k) when you leave your job: You can leave the funds in your former employer's plan (if permitted). Key Takeaways · If you leave your job, you can still maintain your Roth (k) account with your old employer. · Under some circumstances, you can transfer your. A direct (k) rollover gives you the option to transfer funds from your old plan directly into your new employer's (k) plan without incurring taxes or.

If you have saved up more than $ but below $, your employer cannot force a cash out. Instead, it is required by law to transfer the funds to a new. Switching companies and don't know what to do with your (k)? Here are your options · Keep it with your old employer's plan · Roll it over into an IRA · Roll it. If your current employer offers an employer-sponsored (k), you can roll over the assets in your old account into a new (k) account. Doing so would enable. Here are a few k FAQ's after leaving a job: · I could use some extra money. · Can I leave the (k) right where it is and let it continue to grow? · If I. Call your new k company and roll it over. They send a check to the new company in their name. If you do a direct rollover, there won't be. If you leave your (k) with your old employer, you will no longer be allowed to make contributions to the plan. It will still be invested as it was and you. If you leave your job after age 55 you can take penalty-free withdrawals (although you will still pay income taxes). With an IRA, you must wait until age 59 ½. If you withdraw some or all of your balance, you can still decide to roll it over to a new employer's plan or to an IRA within 60 days of receiving the. Leave the money where it is – Many employer plans allow you to keep your money invested even after you leave the company. · Roll in to your new employer's plan –. What You Can Do with a (k) Balance When You Leave · Leave the money where it is (assuming you meet the minimum required balance, typically $) · Roll the. 1. Keep your (k) in your former employer's plan. Most companies—but not all—allow you to keep your retirement savings in their plans after you leave. · 2. A company can hold onto an employee's (k) account indefinitely after they leave, but they are required to distribute the funds if the employee requests it or. You have access to the employer-matched funds in your (k) after leaving a job only if you are fully vested. If not fully vested, you may forfeit some or all. Considerations: Cashing out can put you behind on saving for retirement, so it should typically be a last resort. If you've made after-tax contributions (in a. If you quit a job, your k is your property. Your employer may not remove anything from the account unless you have some unvested employer. Yes. You can transfer your current assets from your old (k) plan or your transitional IRA without having any tax consequences, provided the new employer's. 1. Leaving money in your current plan · 2. Rolling over into a new employer plan · 3. Consolidating multiple accounts with a rollover IRA · 4. Withdrawing your. Although you generally have up to five years to repay loans from your (k) plan account, leaving your job (or losing it) before the loans are repaid may mean. Leaving an employer isn't the only time you can move your (k) savings. Sometimes it makes sense to roll over your (k) assets while you continue to work. An employer-sponsored retirement plan may offer choices for what to do with your account balance in the plan when you decide to change jobs or retire.

Which Is Better The Ipad Air Or Pro

The Air forgoes a few of the features of the Pro, like the superior display and audio, with the result being a nicer price. Internally besides. Both the iPad Air and inch iPad Pro feature a watt-hour battery, while the inch Pro features a larger watt-hour. If your classes require you to stand all the time, the iPad Air is a better choice. They both are good for the notes, web, email, listening to. goodzonemedia.ru: apple ipad air pro. Best Seller. Apple iPad (9th Generation): with A13 Bionic chip, inch. Shop at Best Buy for Apple iPad. Find iPad, iPad mini, iPad Air, iPad Pro, and iPad accessories. 2x better performance in AnTuTu Benchmark (K versus K) · Newer Bluetooth version (v5. · Fingerprint scanner · Comes with mAh larger battery capacity. iPad Air comes with a standard A14 Bionic processor while Apple has stepped up a notch with iPad Pro that gets the ultra-powerful Apple M1 chip. iPad Air comes with a standard A14 Bionic processor while Apple has stepped up a notch with iPad Pro that gets the ultra-powerful Apple M1 chip. The GB 11” iPad Pro is a better value than the GB Air 5, because you're getting ProMotion, a better audio system, an improved camera system with a LIDAR. The Air forgoes a few of the features of the Pro, like the superior display and audio, with the result being a nicer price. Internally besides. Both the iPad Air and inch iPad Pro feature a watt-hour battery, while the inch Pro features a larger watt-hour. If your classes require you to stand all the time, the iPad Air is a better choice. They both are good for the notes, web, email, listening to. goodzonemedia.ru: apple ipad air pro. Best Seller. Apple iPad (9th Generation): with A13 Bionic chip, inch. Shop at Best Buy for Apple iPad. Find iPad, iPad mini, iPad Air, iPad Pro, and iPad accessories. 2x better performance in AnTuTu Benchmark (K versus K) · Newer Bluetooth version (v5. · Fingerprint scanner · Comes with mAh larger battery capacity. iPad Air comes with a standard A14 Bionic processor while Apple has stepped up a notch with iPad Pro that gets the ultra-powerful Apple M1 chip. iPad Air comes with a standard A14 Bionic processor while Apple has stepped up a notch with iPad Pro that gets the ultra-powerful Apple M1 chip. The GB 11” iPad Pro is a better value than the GB Air 5, because you're getting ProMotion, a better audio system, an improved camera system with a LIDAR.

Yes, the inch iPad Pro is better on paper. But the iPad Air 5 has it where it counts: I love the color, the feel of the device, and how. Compare resolution, size, weight, performance, battery life and storage of iPad Pro ‑in. (5th generation), iPad Air (5th generation), iPad (9th. Compare resolution, size, weight, performance, battery life, and storage of iPad Pro 13‑in. (M4), iPad Air 13‑in. (M2), models. Both the iPad Air and inch iPad Pro feature a watt-hour battery, while the inch Pro features a larger watt-hour. Ipad pro and ipad air both are decent machines but depends on the uses and budget that which is good for someone ipad pro Compare resolution, size, weight, performance, battery life, and storage of iPad Pro 11‑in. (4th generation), iPad Air (5th generation), iPad (10th. What is the difference between iPad Air and iPad Pro? · Both come with or inch screens. · Both models feature 12MP rear-facing wide cameras. · Installment-. Is the iPad Pro better than the iPad Air? Yes IPad Pro would be a better option as it has hz display and more cores for gaming and. Compare resolution, size, weight, performance, battery life, and storage of iPad Pro 13‑in. (M4), iPad Air 13‑in. (M2), models. Why is Apple iPad Air () better than Apple iPad Pro 11" ()? · 2GB more RAM memory? 8GBvs6GB · % faster CPU speed? 4 x GHz & 4 x 2 GHzvs4 x The iPad Air comes in a single screen size: inches. However, the iPad Pro comes in 11 inches and inches. Compare resolution, size, weight, performance, battery life, and storage of iPad Pro, iPad Air, iPad, and iPad mini models. Otherwise, the iPad Pro is about 48% faster than the iPad Air. This suggests the iPad Pro performs better under stress. It maintains 26% higher. Well, iPad Pros can handle larger canvases and get more layers. This is because of the 4GB or ram the Pro line has. The new iPad Air has 3GB of RAM but as. We may earn a commission from Amazon for purchases made through the links provided below, but this does not impact our evaluation process. Apple iPad Pro Ipad pro and ipad air both are decent machines but depends on the uses and budget that which is good for someone ipad pro Apple iPad Air () specs compared to Apple iPad Pro (). Detailed up-do-date specifications shown side by side. Why is Apple iPad Pro 11" () better than Apple iPad Air ()? ; 2GB more RAM memory · 6GBvs4GB ; % faster CPU speed · 4 x GHz & 4 x GHzvs2 x The GB 11” iPad Pro is a better value than the GB Air 5, because you're getting ProMotion, a better audio system, an improved camera system with a LIDAR. Compare resolution, size, weight, performance, battery life, and storage of iPad Pro 11‑in. (4th generation), iPad Air (5th generation), iPad (10th.

Eating Disorder Binge Then Starve

:max_bytes(150000):strip_icc()/VWH_Illustration_Signs-of-Binge-Eating-Disorder_Illustrator_Theresa-Chiechi_Final-aec6d4e1006a491b88715e5e6fa7da8e.jpg)

NEDA Blog covers Special Topics, Understanding Eating Disorders, Parents & Caregivers, Recovery, News & Culture, Activism and much more. It is commonly seen in people living with eating disorders such as anorexia nervosa, bulimia nervosa, and binge eating disorder because they may restrict food. Find out what an eating disorder is, and learn about some of the more common eating disorders - including bulimia, anorexia and binge eating. Anorexia nervosa, which is characterized by weight loss or maintenance by extreme dieting, starvation, or too much exercise. Binge eating, which means to. Dieting is one of the most common forms of disordered eating and is common among people with an eating disorder (NEDC, ). Most “fad” diets prescribe far too. Eating Disorder Not Otherwise Specified. However, where classification is possible there are three main categories. Anorexia Nervosa; Bulimia Nervosa; Binge. Bulimia is an eating disorder. It is characterized by uncontrolled episodes of overeating, called bingeing. This is followed by purging with methods such as. An eating disorder is a mental disorder defined by abnormal eating behaviors that adversely affect a person's physical or mental health. Read about bulimia nervosa, an eating disorder and mental health condition where someone is binge eating, then purging the food from their body by making. NEDA Blog covers Special Topics, Understanding Eating Disorders, Parents & Caregivers, Recovery, News & Culture, Activism and much more. It is commonly seen in people living with eating disorders such as anorexia nervosa, bulimia nervosa, and binge eating disorder because they may restrict food. Find out what an eating disorder is, and learn about some of the more common eating disorders - including bulimia, anorexia and binge eating. Anorexia nervosa, which is characterized by weight loss or maintenance by extreme dieting, starvation, or too much exercise. Binge eating, which means to. Dieting is one of the most common forms of disordered eating and is common among people with an eating disorder (NEDC, ). Most “fad” diets prescribe far too. Eating Disorder Not Otherwise Specified. However, where classification is possible there are three main categories. Anorexia Nervosa; Bulimia Nervosa; Binge. Bulimia is an eating disorder. It is characterized by uncontrolled episodes of overeating, called bingeing. This is followed by purging with methods such as. An eating disorder is a mental disorder defined by abnormal eating behaviors that adversely affect a person's physical or mental health. Read about bulimia nervosa, an eating disorder and mental health condition where someone is binge eating, then purging the food from their body by making.

Common types of eating disorders are anorexia, bulimia, binge eating, and avoidant/restrictive food intake disorder (ARFID). Anorexia. People with anorexia: eat. Eating disorders include anorexia nervosa, a form of self-starvation; bulimia nervosa, in which individuals engage in repetitive cycles of binge-eating. These include anorexia nervosa, bulimia nervosa, avoidant/restrictive food intake disorder, and binge eating disorder. ANOREXIA NERVOSA, BULIMIA NERVOSA, BINGE EATING DISORDER (BED), AVOIDANT/RESTRICTIVE FOOD INTAKE DISORDER (ARFID), ORTHOREXIA NERVOSA, COMPULSIVE OVER. Typically we think of anorexia as total starvation and bulimia as the cousin with “less self control “ (which is most definitely not an. An episode of binge eating is characterized by both of the following: Eating, in a discrete period of time (e.g., within any 2-hour period), an amount of food. Common eating disorders include anorexia nervosa, bulimia nervosa, binge-eating disorder, and avoidant restrictive food intake disorder. Each of these disorders. This content isn't available. Stop feeding the demon | how I overcame my binge. Read about binge eating disorder, which is when a person feels compelled to overeat on a regular basis. Find out about the symptoms, treatments and possible. Anorexia Nervosa is an eating disorder characterized by an intense fear of weight gain. It involves an ongoing pattern of self-starvation and a preoccupation. Do you struggle with binge eating? Learn about compulsive overeating, binge eating disorder, and what you can do to stop it. I don't deserve to eat.” As well, now this woman isn't just working full-time as an Anorexic, but she is now a slave for 3 eating disorders Anorexia, Binging/. Find 11 tips for beating the binge eating cycle in this guide from goodzonemedia.ru Learn how to get back to a healthier relationship with food here. The chance of successfully treating someone who has an eating disorder is greater if detected early and the person gets help. Learn more. The most common are anorexia nervosa, bulimia nervosa, binge eating disorder, avoidant restrictive food intake disorder (ARFID) and other specified feeding and. Binge-eating disorder is the most common eating disorder in the United States, yet remains the overlooked middle child compared to its better-known siblings. Teens with eating disorders may starve themselves (anorexia nervosa), or they may binge on food and then throw up or take laxatives to purge themselves of the. Non-purging bulimia involves eating a lot of food at once (bingeing) and then using methods like diet and exercise to limit weight gain. Binge eating disorder controlled my life for 10 years. During this time, it felt like food controlled me. I was always trying to lose weight.

What To Invest In Today Robinhood

Robinhood helps you run your money your way. Trade stocks, options, ETFs stocks for decades but millennials want to improve their life today! At. After Hours: $ (%) ; In the news. Yahoo Finance. 1 day ago. Winners And Losers Of Q2: Robinhood (NASDAQ:HOOD) Vs The Rest Of The Online. Invest in stocks, options, and ETFs at your pace and commission-free. Investing Disclosures. Learn more. Stocks & funds offered through Robinhood Financial. Robinhood is one of the few brokerage accounts that offers access to penny stocks — stocks that can be purchased for $5 or less. Here's how to. This investment will be worth: $8, Navigate the complexities of investing with the guidance of a financial advisor. Take our free quiz to get started today. Robinhood Markets, Inc. is an American financial services company headquartered in Menlo Park, California. The company provides an electronic trading. Instead, I would consider a broad market ETF, of which there are several available on Robinhood, such as the Vanguard Total Market ETF (VTI). Get the latest Robinhood Markets, Inc. (HOOD) stock news and headlines to help you in your trading and investing decisions. Brokerage services are offerred through Robinhood Financial LLC, a registered broker-dealer with clearing services through Robinhood Securities, LLC, a. Robinhood helps you run your money your way. Trade stocks, options, ETFs stocks for decades but millennials want to improve their life today! At. After Hours: $ (%) ; In the news. Yahoo Finance. 1 day ago. Winners And Losers Of Q2: Robinhood (NASDAQ:HOOD) Vs The Rest Of The Online. Invest in stocks, options, and ETFs at your pace and commission-free. Investing Disclosures. Learn more. Stocks & funds offered through Robinhood Financial. Robinhood is one of the few brokerage accounts that offers access to penny stocks — stocks that can be purchased for $5 or less. Here's how to. This investment will be worth: $8, Navigate the complexities of investing with the guidance of a financial advisor. Take our free quiz to get started today. Robinhood Markets, Inc. is an American financial services company headquartered in Menlo Park, California. The company provides an electronic trading. Instead, I would consider a broad market ETF, of which there are several available on Robinhood, such as the Vanguard Total Market ETF (VTI). Get the latest Robinhood Markets, Inc. (HOOD) stock news and headlines to help you in your trading and investing decisions. Brokerage services are offerred through Robinhood Financial LLC, a registered broker-dealer with clearing services through Robinhood Securities, LLC, a.

Robinhood Markets, Inc. operates financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds. The J.P. Morgan / Robin Hood Investors Conference gathers experts in investing Today, he is chairman of the Paulson Institute, which aims to foster a. Bonus Tip: Use this link to get free investing money ($5-$) when you open and fund your account with at least $ sign up for Robinhood today, you'll get a. Robinhood is one of Silicon Valley's most valuable and fastest-growing startups. And the fintech firm that pioneered commission-free stock trading is soon. What is the Investor Index? Robinhood Investor Index tracks the performance of the top most owned investments on Robinhood, in aggregate. News & Analysis ; Is Robinhood Stock a Buy? Leo Sun | Aug 12, ; Float: Definition, How It Works, Example. Motley Fool Staff | Aug 5, ; How to Invest in. Today, we are excited to launch joint investing accounts, which allow customers Introducing the Robinhood Crypto Trading API · Crypto · Introducing the. The S&P is one of the most widely-followed stock market indices in the world and there are many funds that invest based on the index. These five stand out. What to Buy These Stocks Moved the Most Today: Walmart, Lumentum, Ulta, Dell, Robinhood, Tesla, and More. Aug. 15, p.m. ET. Robinhood Stock Pops. View the real-time HOOD price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. By the way, you can open a joint investing account with a partner to manage investments together and transfer funds at any time! Start today on Robinhood: http. If you're seeking a full-service investment brokerage platform with access to bonds, mutual funds and futures trading, Robinhood isn't for you. That said, it. At Robinhood, we believe the financial system should be built to work for everyone. That's why we create products that let you start investing at your own. Markets These Stocks Moved the Most Today: Walmart, Lumentum, Ulta, Dell Fintech Robinhood Stock Pops. Why It's Gained Two Bulls This Week. Aug. If you're seeking a full-service investment brokerage platform with access to bonds, mutual funds and futures trading, Robinhood isn't for you. That said, it. Penny Stocks to Buy Today on Robinhood , Robinhood Investment Today, Best Cheap Robinhood Stocks, Robinhood Cheap Crypto to Buy Today, Robinhoodstockwatch. Robinhood (HOOD) reported Q2 earnings per share (EPS) of $, beating estimates of $ by %. In the same quarter last year, Robinhood's earnings. Robinhood is one of Silicon Valley's most valuable and fastest-growing startups. And the fintech firm that pioneered commission-free stock trading is soon.

On Deck Business Financing

Lender Details · Loan amount. $5,$, · Interest rate. % APR · Term lengths. months · Min. annual revenue. $, · Min. time in business. 1. The New Mexico Legislature recently expanded the Small Business Recovery Loan Fund to better help businesses experiencing financial hardship caused by the. OnDeck offers small business loans and financing in Canada. Read reviews and apply online to get a quick business loan from OnDeck. Our business financing and lending solutions can provide you with the quick access to funds loans and loan amounts are subject to On Deck approval. On Deck Capital, Inc. provides capital financing services to businesses. The Company offers online tools and resources including data aggregation and. funding can take an average of 5 business days. Pros: Loans available for fair credit borrowers. No prepayment penalty. Joint loan applications accepted. In this guide, we explain the requirements, repayment structures, fee system, along with the pros & cons of business lender OnDeck Capital. OnDeck is a leader in lending for small business financing and has delivered over US$13 billion worldwide. On Deck Capital Australia Pty Ltd ABN 28 OnDeck Capital is an American small business lending company with offices in Chicago, IL; New York, NY; Denver, CO, and South Jordan, UT. Lender Details · Loan amount. $5,$, · Interest rate. % APR · Term lengths. months · Min. annual revenue. $, · Min. time in business. 1. The New Mexico Legislature recently expanded the Small Business Recovery Loan Fund to better help businesses experiencing financial hardship caused by the. OnDeck offers small business loans and financing in Canada. Read reviews and apply online to get a quick business loan from OnDeck. Our business financing and lending solutions can provide you with the quick access to funds loans and loan amounts are subject to On Deck approval. On Deck Capital, Inc. provides capital financing services to businesses. The Company offers online tools and resources including data aggregation and. funding can take an average of 5 business days. Pros: Loans available for fair credit borrowers. No prepayment penalty. Joint loan applications accepted. In this guide, we explain the requirements, repayment structures, fee system, along with the pros & cons of business lender OnDeck Capital. OnDeck is a leader in lending for small business financing and has delivered over US$13 billion worldwide. On Deck Capital Australia Pty Ltd ABN 28 OnDeck Capital is an American small business lending company with offices in Chicago, IL; New York, NY; Denver, CO, and South Jordan, UT.

OnDeck offers small business loans and financing in Canada. Read reviews and On Deck is by far the most reliablefinancial team I ever dealt with. Business Loan Basics. There are many sources of debt financing: banks, savings and loans, commercial finance companies and government agencies are most. Government-Guaranteed Loans to Support the Growth of Your Business · New businesses looking for financial support to start or grow a company · Established. This allows businesses to spend their time where it provides the most benefit—on their customers, not looking for a small business loan. Since , we've. Short term business loans with OnDeck. Apply today for hassle free flexible small business loan in under 10 min up to $K. Don't delay apply today. Finally, A Deck Building Company with Deck Financing Why hold off on the project of your dreams? Archadeck's Buy & Build Payment Program provides financing. Since , Noah Breslow has been the chairman and chief executive officer of On Deck Capital, Inc., one of the leading small business lenders. Funding subject to lender approval. Flex Funds is not a loan but a sale of future credit and debit receivables. Pricing for Business Term Loans ranges from 8%-. This is written from the perspective of Horn Capital. Growth Financing. Growth Financing Training Deck · Growth Financing Training Source Materials; Additional. Empower with Smart Finance. Boost your business with smart financial solutions that streamline operations, improve cash flow, and drive growth. Focus on. OnDeck is specifically a term loan lender, offering anywhere from $5, to $, in financing. A loan from OnDeck on the larger end of that. OnDeck provides term loans and lines of credit for small businesses. Businesses must have been in operation for at least a year with a minimum of $, On Deck. Loan amounts. $5, to $, Starting interest rate. %. Term A fast business loan is a type of small business financing where the. Establishing and nurturing a small business credit p Tony financial kredit assistance and 3 others. loan platform, small business loans, fair financing business financing, instant decision, small business working capital, and small business growth. Ondeck is a technology-enabled financial platform that provides loan financing to small and medium-sized businesses On Deck lays off a third of staff after. The GreenSky Loan Program offers access to a fast, frictionless home improvement loan process. It enables contractors to offer a range of financing options. On Deck Capital, Inc. is an on-line platform that uses a big data, analytic model to source, underwrite, and fund loans to small businesses. businesses and certain non-bank small business financing alternatives such as merchant cash advances. From to , the weighted average APR for term loans. Comprehensive guide on the best banks for business loans, the types of loans available and the steps to take to apply for a small business loan.

Top Best Cryptocurrency

Top 50 cryptocurrencies · 1 Bitcoin BTC. $ 63, $ T $ trillion · 2 Ethereum ETH. $ 2, $ B $ billion · 3 Tether USD USDT. $. Today's Top Crypto Gainers & Trending Crypto Analysis ; 1. Pi ; 2. Dogcoin ; 3. Bitcoin ; 4. Ethereum ; 5. Dogecoin. Top 10 cryptocurrencies of ; 1. Bitcoin (BTC) · $60, · $ trillion ; 2. Ethereum (ETH) · $2, · $ billion ; 3. BNB (BNB) · $ · $ billion. View crypto prices and charts, including Bitcoin, Ethereum, XRP, and more. Earn free crypto. Market highlights including top gainer, highest volume. OKX helps you find out the best cryptocurrency to buy and trade with real time prices. Buy bitcoin, ethereum, litecoin, carnado and many more in just a few. Currently, the 3 largest cryptocurrency exchanges are Bybit, OKX, and Coinbase Exchange. Total tracked crypto exchange reserves currently. 1. Ethereum (ETH) · 2. Tether (USDT) · 3. XRP · 4. Binance Coin (BNB) · 5. USD Coin (USDC) · 6. Cardano (ADA) · 7. Solana (SOL) · 8. Dogecoin (DOGE). Top 10 Cryptocurrencies · Price analysis 8/ BTC, ETH, BNB, SOL, XRP, · Price analysis 8/ BTC, ETH, BNB, SOL, XRP, · Price analysis 8/ SPX, DXY, BTC, ETH. One of the most prominent names in the crypto exchanges industry is Binance. Founded in , the exchange quickly reached the number one spot by trade volumes. Top 50 cryptocurrencies · 1 Bitcoin BTC. $ 63, $ T $ trillion · 2 Ethereum ETH. $ 2, $ B $ billion · 3 Tether USD USDT. $. Today's Top Crypto Gainers & Trending Crypto Analysis ; 1. Pi ; 2. Dogcoin ; 3. Bitcoin ; 4. Ethereum ; 5. Dogecoin. Top 10 cryptocurrencies of ; 1. Bitcoin (BTC) · $60, · $ trillion ; 2. Ethereum (ETH) · $2, · $ billion ; 3. BNB (BNB) · $ · $ billion. View crypto prices and charts, including Bitcoin, Ethereum, XRP, and more. Earn free crypto. Market highlights including top gainer, highest volume. OKX helps you find out the best cryptocurrency to buy and trade with real time prices. Buy bitcoin, ethereum, litecoin, carnado and many more in just a few. Currently, the 3 largest cryptocurrency exchanges are Bybit, OKX, and Coinbase Exchange. Total tracked crypto exchange reserves currently. 1. Ethereum (ETH) · 2. Tether (USDT) · 3. XRP · 4. Binance Coin (BNB) · 5. USD Coin (USDC) · 6. Cardano (ADA) · 7. Solana (SOL) · 8. Dogecoin (DOGE). Top 10 Cryptocurrencies · Price analysis 8/ BTC, ETH, BNB, SOL, XRP, · Price analysis 8/ BTC, ETH, BNB, SOL, XRP, · Price analysis 8/ SPX, DXY, BTC, ETH. One of the most prominent names in the crypto exchanges industry is Binance. Founded in , the exchange quickly reached the number one spot by trade volumes.

Rankings ; 1. Bitcoin BTC. $63, ; 2. Ethereum ETH. $2, ; 3. Tether USDT. $ ; 4. BNB BNB. $

Best Crypto to Buy Now: Cryptocurrencies with the Most Potential · Solana (SOL). Solana is a high-performance blockchain renowned for its speed and efficiency. Top Cryptocurrency Companies () · TBD · Chainlink Labs · Flourish · Block · FPFX Tech · Alchemy · Fortress IO · Hiro Systems. Cryptocurrencies have captured the attention and imagination of a new generation of investors across the globe. From Bitcoin to Ethereum to the growing list. Total Cryptocurrency Market Cap: $2,,,, ; 2, Ethereum (ETH), ,,, ; 3, Tether USDt (USDT), ,,, ; 4, BNB (BNB), 85,,, ; 5. Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web news with analysis, video and live price updates. Market Overview Total crypto market cap, volume charts, and market overview. Top Gainers Best performing cryptocurrencies over the last 24 hours. Top Losers. BitPay is the best crypto app to pay with crypto and accept crypto payments. Create a wallet to buy, store, swap and spend securely. Top cryptocurrency prices and charts, listed by market capitalization. Free access to current and historic data for Bitcoin and thousands of altcoins. Assets that have a similar market cap to Cryptocurrency Top 10 Tokens Index include Ethereum, Tether, BNB, and many others. To see a full list, see our. Coinbase has grown to be one of the top crypto exchanges in the world, with more than 98 million verified users trading more than supported cryptocurrencies. Today's Cryptocurrency Prices ; 2. E · Ethereum. ETH ; 3. T · Tether. USDT ; 4. B · BNB. BNB ; 5. S · Solana. SOL. Bitcoin, ETH & Solana: Top 3 coin according to Market cap are probably the best to buy & hodl at the moment for the long term. 10 Largest Cryptocurrencies by Market Capitalization · 1. Bitcoin (BTC) · 2. Ethereum (ETH) · 3. Tether (USDT) · 4. USD Coin (USDC) · 5. Binance Coin (BNB) · 6. Top Cryptocurrency Companies () · TBD · Chainlink Labs · Flourish · Block · FPFX Tech · Alchemy · Fortress IO · Hiro Systems. Assets that have a similar market cap to Cryptocurrency Top 10 Tokens Index include Ethereum, Tether, BNB, and many others. To see a full list, see our. Best Cryptos For Day Trading · Bitcoin · Ethereum · Binance Coin · Ripple (XRP) · Solana. In this fast-paced industry, continuous learning is a crypto holder's #1 tool to staying on top. Discover the best resources to help you strengthen your. According to the Ripple website, transactions settle on the XRP Ledger in seconds. This is significantly faster than other cryptocurrencies like Bitcoin. Advanced Micro Devices (AMD) Coinbase Global (COIN) and Nvidia (NVDA) are some of the most trending Cryptocurrency Stocks. See how they compare to other. TOP 10 Best Crypto Exchanges of · 1. Binance Review · 2. Bybit Review · 3. Kraken Review · 4. Coinbase Review · 5. BYDFi Review · 6. KuCoin Review · 7. Huobi.

Home Loan Based On Rental Payments

Down payment: For government-backed mortgages, 0% to 3% may be acceptable on a mortgage for a primary residence but borrowers for investment real estate. First, if you have rented out your home for 12 months and can show 12 months of rental income on your tax return, your lender will not count your current. Rental properties, especially short-term rentals are booming, the profitability for short-term rentals means you qualify for a rental property loan based on the. Benefits of DSCR Mortgage Loans: · APPROVAL: Based on the property cash flow, instead of your personal income. · NO SEASONING HASSLES: · FOREIGN NATIONALS. A DSCR loan allows real estate investors to secure financing based on the rental income of a property rather than their personal income. If you don't have a mortgage which shows your monthly on your credit report, I usually put $1 for rent. Yes, high rent eats into your DTI. Lying. Thrive Mortgage is helping first-time homebuyers ensure their rent payment history counts towards their mortgage evaluation. Enter the monthly rent payment. This calculator will give you an estimate on how your current rental payments could service a home loan based on the current interest rates and loan term. Because DSCR measures the asset's ability to pay the property's mortgage *Rental loan rates are based on loan terms, borrower qualifications, LTV. Down payment: For government-backed mortgages, 0% to 3% may be acceptable on a mortgage for a primary residence but borrowers for investment real estate. First, if you have rented out your home for 12 months and can show 12 months of rental income on your tax return, your lender will not count your current. Rental properties, especially short-term rentals are booming, the profitability for short-term rentals means you qualify for a rental property loan based on the. Benefits of DSCR Mortgage Loans: · APPROVAL: Based on the property cash flow, instead of your personal income. · NO SEASONING HASSLES: · FOREIGN NATIONALS. A DSCR loan allows real estate investors to secure financing based on the rental income of a property rather than their personal income. If you don't have a mortgage which shows your monthly on your credit report, I usually put $1 for rent. Yes, high rent eats into your DTI. Lying. Thrive Mortgage is helping first-time homebuyers ensure their rent payment history counts towards their mortgage evaluation. Enter the monthly rent payment. This calculator will give you an estimate on how your current rental payments could service a home loan based on the current interest rates and loan term. Because DSCR measures the asset's ability to pay the property's mortgage *Rental loan rates are based on loan terms, borrower qualifications, LTV.

“If you are in a situation where you are unable to make timely payments on your mortgage, you may consider renting out your home for a period of time,” says. Because DSCR measures the asset's ability to pay the property's mortgage *Rental loan rates are based on loan terms, borrower qualifications, LTV. You will still need a deposit of at least 5% of the property value to use your rental history as genuine savings. Will My Rent Be Accepted As Genuine Savings? Banks that are reluctant to lend more than one mortgage loan per borrower; Higher down payment requirements; Higher cash reserve requirements; Needing a credit. The tool will take your current monthly rent payment and then take into account several anticipatory features of future home ownership in order to give you a. Have you ever thought your rent payment would be better spent paying your own mortgage? Are you wondering how much you could borrow based on mortgage. Your monthly mortgage payment has four components: principal, interest, taxes, and insurance. Homeowners insurance. Homeowners insurance is a type of property. As well, lenders will definitely take your rental payments into account when looking at your home loan application. But depending on the lender, they won't. Your home purchase breaks even in approximately years. Mortgage and Home Expenses: Monthly house payment: $2, [-]. Down payments starting at 15% Footnote(Opens Overlay) depending on loan size, property type and credit score. Additional benefits with Chase. What Is an Investment Property Loan? An investment property loan can help you purchase an income-generating property. You might intend to rent this property. If you don't have a sizable down payment, for instance, or your credit score is too low to qualify for a mortgage, renting a property with the intention to buy. The DTI is the total house payment including taxes, insurance and mortgage insurance, if any, plus any other monthly debt payments, all divided. What Is an Investment Property Loan? An investment property loan can help you purchase an income-generating property. You might intend to rent this property. 50% Rule—A rental property's sum of operating expenses hovers around 50% of income. Operating expenses do not include mortgage principal or interest. The other. You will still need a deposit of at least 5% of the property value to use your rental history as genuine savings. Will My Rent Be Accepted As Genuine Savings? Home Value: · Down Payment: · Loan Amount: · Interest Rate: · Loan Term: · Start Date: · Property Tax: · PMI. This calculator will give you an estimate on how your current rental payments could service a home loan based on the current interest rates and loan term. If you purchase a house and rent it out the rental income may cover the monthly payments or may not. It depends on the local economy, the level. Down payment: For government-backed mortgages, 0% to 3% may be acceptable on a mortgage for a primary residence but borrowers for investment real estate.

What Does Target Date Fund Mean

What is a target date fund? Here, we're referring to the State Street Target What do the years in the target date fund's names mean? The years. Although cash probably is the safest investment over very short investment periods, we demonstrate that only very large cash allocations can significantly. Target date funds are designed to be long-term investments for individuals with particular retirement dates in mind. Voya's Target Date Blend Series are designed to specifically balance the evolving risk-return profiles of participants as they age to maximize the probability. Target date funds are funds with the target date being the approximate date when investors plan to start withdrawing their money. The target date of the target. A target date fund is a type of mutual fund structured to make it easier for investors to maintain a desirable asset allocation over time. A target-date fund operates under an asset allocation formula that assumes you will retire in a certain year and adjusts its asset allocation model as it gets. We blend investment theory and behavioral insights to design target-date funds (TDFs) that focus on helping investors save enough to have lasting retirement. The year in the Fund name refers to the approximate year (the target date) when an investor in the Fund would retire and leave the work force. What is a target date fund? Here, we're referring to the State Street Target What do the years in the target date fund's names mean? The years. Although cash probably is the safest investment over very short investment periods, we demonstrate that only very large cash allocations can significantly. Target date funds are designed to be long-term investments for individuals with particular retirement dates in mind. Voya's Target Date Blend Series are designed to specifically balance the evolving risk-return profiles of participants as they age to maximize the probability. Target date funds are funds with the target date being the approximate date when investors plan to start withdrawing their money. The target date of the target. A target date fund is a type of mutual fund structured to make it easier for investors to maintain a desirable asset allocation over time. A target-date fund operates under an asset allocation formula that assumes you will retire in a certain year and adjusts its asset allocation model as it gets. We blend investment theory and behavioral insights to design target-date funds (TDFs) that focus on helping investors save enough to have lasting retirement. The year in the Fund name refers to the approximate year (the target date) when an investor in the Fund would retire and leave the work force.

In addition, under the assumptions underlying the Capital Asset. Pricing Model (CAPM), all target-date funds are efficient investments and lie on the mean-. Target-date funds take asset allocation and investment selection wholly out of investors' hands—not just at a single point in time but at least until. A Target Retirement fund is a ready-made portfolio that makes investing for retirement simple. You simply choose a fund based on when you plan to retire and we. Rowe Price target date trusts, and their underlying trusts (the Trusts) are not mutual funds; rather the Trusts are operated and maintained so as to qualify for. Target-date funds are designed to help manage investment risk. You pick a fund with a target year that is closest to the year you anticipate retiring. Target date funds are set up based on the target retirement year, with asset allocation already predetermined. For beginner investors, this option may sound. A target date mutual fund is a type of asset allocation mutual fund where the mix of securities and asset classes, equities and fixed income for example. Target date funds can be used to help build and maintain an age-appropriate retirement investment strategy. Target date funds enable DC members to save into a single investment fund, based on their estimated retirement date. Target date mutual funds let you invest in a single portfolio with an asset mix that becomes more conservative as the target date nears. How Do They Work? Target date funds make investing for retirement more convenient by automatically changing your investment mix or asset allocation over time. A target-date fund is a mutual fund that invests with a strategy designed around a specific end date. · Target-date funds are popular among those investing for. Target-date funds are popular options within workplace retirement plans, such as (k)s, but you can also invest in a target-date fund privately. Managing. A target date fund is an investment fund – typically a mutual fund — that is “actively managed to a certain date.” What does that mean? It means that the fund's. The American Funds Target Date Retirement Series is a professionally managed collection of mutual funds designed to help you invest for retirement. Investment Options that correspond with the year closest to when you will be the target retirement age, defined as age Each Target Retirement Fund has a. Although cash probably is the safest investment over very short investment periods, we demonstrate that only very large cash allocations can significantly. In addition, under the assumptions underlying the Capital Asset. Pricing Model (CAPM), all target-date funds are efficient investments and lie on the mean-. Target-date funds, which offer age-dependent combinations of equity and bonds, can be introduced into annuitized investing to cover a larger spectrum of.