goodzonemedia.ru

Tools

Define Dwi

Driving while intoxicated (DWI) and driving under the influence (DUI) are quite similar. However, DWI could mean that someone operated a motor vehicle while. The ultimate difference between DWI and DUI in Texas is that DUI only applies to minors under the legal drinking age of a minor can be charged with DWI if. DWI stands for driving while intoxicated, while DUI means driving under the influence. Texas law defines both of these terms differently. Need Help? Have you been arrested for drunk driving in Minnesota? Whether the arresting officer called it a DWI or a DUI makes no difference, you are still. Driving under the influence (DUI) is the offense of driving, operating, or being in control of a vehicle while impaired by alcohol or drugs. Driving while intoxicated (DWI) is a crime that occurs when a person drives a motor vehicle after consuming enough alcohol to raise their blood alcohol. What is DWI? Driving While Intoxicated (DWI) is a crime. DWI laws are strictly enforced in New York State. Penalties include loss of driving privileges. What Is DUI? What Is DWI? Under Nebraska law, you can be convicted of Driving While Under the Influence of Alcohol Or Of Any Drug (Nebraska Revised Statute § What is DWI? New Jersey law defines driving while intoxicated (DWI) as driving while one's blood alcohol content (BAC) is at least %. New Jersey. Driving while intoxicated (DWI) and driving under the influence (DUI) are quite similar. However, DWI could mean that someone operated a motor vehicle while. The ultimate difference between DWI and DUI in Texas is that DUI only applies to minors under the legal drinking age of a minor can be charged with DWI if. DWI stands for driving while intoxicated, while DUI means driving under the influence. Texas law defines both of these terms differently. Need Help? Have you been arrested for drunk driving in Minnesota? Whether the arresting officer called it a DWI or a DUI makes no difference, you are still. Driving under the influence (DUI) is the offense of driving, operating, or being in control of a vehicle while impaired by alcohol or drugs. Driving while intoxicated (DWI) is a crime that occurs when a person drives a motor vehicle after consuming enough alcohol to raise their blood alcohol. What is DWI? Driving While Intoxicated (DWI) is a crime. DWI laws are strictly enforced in New York State. Penalties include loss of driving privileges. What Is DUI? What Is DWI? Under Nebraska law, you can be convicted of Driving While Under the Influence of Alcohol Or Of Any Drug (Nebraska Revised Statute § What is DWI? New Jersey law defines driving while intoxicated (DWI) as driving while one's blood alcohol content (BAC) is at least %. New Jersey.

What is DWI? Driving While Intoxicated (DWI) is a crime. DWI laws are strictly enforced in New York State. Penalties include loss of driving privileges. What is a DWI? Some states strictly define a DWI as “driving while intoxicated,” which limits its application to alcohol. Others expand the definition to. Both terms refer to driving a vehicle while under the influence of alcohol, drugs, or both. While both terms describe impaired driving in this sense, “DUI” is. In colloquial language, “DWI” stands for “driving while impaired,” while “DUI” stands for “driving under the influence.” Despite their widespread use in Canada. In some jurisdictions, DWI applies if you are below the legal limit but still determined to be impaired, while DUI is what you get charged with. DWI definition: driving while intoxicated. See examples of DWI used in a sentence. What is a DUI? The crime of driving under the influence of any substance that causes inebriation, intoxication, or otherwise impedes the safe operation of a. DWI is essentially the same thing as DUI or Driving Under the Influence. The state of California uses the term “DUI” exclusively. DWI answers are found in the Taber's Medical Dictionary powered by Unbound Medicine. Available for iPhone, iPad, Android, and Web. Under the Influence. All states essentially have two types of DUI laws—impairment and per se laws. In other words, you can be convicted of a DUI: The level of. DWI (driving while intoxicated) refers only to intoxication by alcohol. DUI (driving under the influence) refers to the offense of having both alcohol and drugs. Driving while under the influence (DUI) and/or driving while intoxicated/impaired (DWI) are criminal driving offenses in all states. There is no notable difference between DUI, DWI, OVI, and OMVI. They all penalize driving or operating a vehicle while intoxicated or impaired. Both DUI and DWI refer to the illegal act of driving a vehicle while impaired by alcohol and/or drugs. The chief difference lies in what the letters mean. DUI. DWI definition: driving while intoxicated. See examples of DWI used in a sentence. FREE CONSULTATION Call 24/7- What is the difference between DUI and DWI? Driving under the influence and driving while intoxicated are the. Definition: DWI stands for "Driving While Intoxicated." It refers to the act of operating a motor vehicle while under the influence of drugs or alcohol. What Is the Difference Between a DUI and a DWI? Operating a motor vehicle under the influence of drugs or alcohol is referred to with many different acronyms. Most people have heard of both acronyms for the generic motor vehicle crime of operating while intoxicated, “drunk driving” or impaired driving. What is DWI? A DWI conviction is a serious charge that can stay on your criminal record for 25 years. There are many different types of DWI in New York and.

Schools First Cd Account

A Share Savings account is required for membership at the credit union. It can be opened with as little as $5, and the $5 minimum must be maintained to remain a. Share certificates from Service Credit Union are like a CD and offer a smarter way to save more with rates as high as % APY*. Open one with as little as $ · Make unlimited deposits at any time. · Renew it every 12 months until the student reaches age · Rest assured your savings. Share Certificate rates are in effect until the maturity date. APY is based on the assumption that dividends remain within the account. The dividend rate and. A Share Certificate (also known by CD or Certificate of Deposit by banks) offers guaranteed returns on your savings. How much? Use this calculator to find. Ultimately, keep in mind that the credit score needed for a SchoolsFirst FCU credit card is typically “excellent” (+). But there are exceptions, too. If you. Share Certificates. Share certificates earn higher dividend rates than our regular savings account, in terms ranging from 30 days to 60 months. Rates vary by. A Share Certificate from First Financial Credit Union in CA is an ideal short-term and high yield savings account. Review our CD rates and open an account! SchoolsFirst Federal Credit Union CD Rates ; OTHER TIERS: % → $ - $20k | % → $20k - $50k | % → $50k - $k | % → $k - $k. A Share Savings account is required for membership at the credit union. It can be opened with as little as $5, and the $5 minimum must be maintained to remain a. Share certificates from Service Credit Union are like a CD and offer a smarter way to save more with rates as high as % APY*. Open one with as little as $ · Make unlimited deposits at any time. · Renew it every 12 months until the student reaches age · Rest assured your savings. Share Certificate rates are in effect until the maturity date. APY is based on the assumption that dividends remain within the account. The dividend rate and. A Share Certificate (also known by CD or Certificate of Deposit by banks) offers guaranteed returns on your savings. How much? Use this calculator to find. Ultimately, keep in mind that the credit score needed for a SchoolsFirst FCU credit card is typically “excellent” (+). But there are exceptions, too. If you. Share Certificates. Share certificates earn higher dividend rates than our regular savings account, in terms ranging from 30 days to 60 months. Rates vary by. A Share Certificate from First Financial Credit Union in CA is an ideal short-term and high yield savings account. Review our CD rates and open an account! SchoolsFirst Federal Credit Union CD Rates ; OTHER TIERS: % → $ - $20k | % → $20k - $50k | % → $50k - $k | % → $k - $k.

SchoolsFirst Federal Credit Union CD Rates · 5-Year Jumbo CD - % APY · Month Share Certificate - % APY · Month Jumbo CD - % APY · 6-Month Jumbo CD. Schools First money market offers an APY starting at % and ranging up to % (APY stands for annual percentage yield, rates may change). Where the future starts today. · Auto Loans · Savings Account · Learn with Banzai · Business Hours · Branch Location · Mailing Address · Phone Numbers. Early withdrawal penalties may apply. Fees could reduce the earnings on the account. For complete account terms and conditions, refer to our Statements of Terms. Share Certificates offer better rates than regular savings, as long as you're willing to leave your money untouched for a set period of time. Money Market Accounts. Enjoy the flexibility of a checking account with the high earnings of a savings account. APY† up to %. Initial Deposit $1, View. The nice thing about schools first is that they can set up a “summer saver” savings account for you. It's separate from your regular savings. Use the SchoolsFirst FCU calculators to estimate your budget, savings, loan, and mortgage needs and more. Up to % APY on a 6-month Relationship share certificate (CD). Learn about share certificates. Have an account with another financial institution? No problem? You can easily transfer money between accounts with Money Mover. Open an account with no balance required. Earn dividends on your account balance. No monthly fees. Deposit as much as you want each month. Only one share certificate type available. SchoolsFirst CD only offers traditional share certificate accounts. · Very high annual percentage yield (APY). · $ A dividend-earning savings account with a low minimum balance of $5. · An ATM card (with parent's approval). · Available College Saver Share Certificate, with a. Deposit Rates - August 24, ; 12 Mo CD. %, $, ; 15 Month Promotional. %, $ ; 18 Mo CD. %, $ ; Month. %, $20, Susana N. 0. 3. 3 months ago. My experience with Schools First at Pasadena has been so positive. I first came in about four weeks ago to open an account. The redesigned SchoolsFirst FCU Mobile Banking app makes managing your accounts anytime, anywhere easier and more convenient than ever before. To really maximize your earnings, try a certificate account. With competitive rates and flexible terms, you can put your savings on the “fast track” and earn. Credit Union · Banking at your fingertips! · Outstanding Auto Loan Rates! · Free Checking · Visa Balance Transfer · Youth Savings Account · Featured Rates · Member. Stay away from schools first. They have the WORST website that makes you waste so much time to make payments from external accounts. courteously. My daughter and son now both have accounts at this credit union. Intro. Impact. CTAs. Serving. Counters. Testimonials. County Schools FCU.

Best Credit Card To Start With No Credit

Get a Discover credit card with no credit score required to apply · Student Cash Back Credit Card · Student Chrome Credit Card · Secured Credit Card. American Express Blue Business Cash: Best overall credit card for new businesses with no credit history with instant approval and expanded buying power; U.S. Chase Freedom Rise®: Best for No-deposit starter card: Solid rewards on everything · Discover it® Student Chrome: Best for Student cards: Simplicity and value. OpenSky Secured Visa: The OpenSky Secured Visa is a no credit check card that's also a secured credit card. · First Progress Platinum Elite Secured Mastercard. The Freedom Rise card is a good starter card, and you should be able to product change it to one of the better cards like the Unlimited or the Flex in the. PREMIER Bankcard credit cards are for building credit. Start building credit by keeping your balance low and paying all your bills on time each month. Credit Cards for No Credit · Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER. TD Bank offers a great starter credit card. It's a secured credit card that even includes Cash Back rewards. TD's cards offer online access to your account, and. The best credit cards for people with no credit are Petal® 2 Visa® Credit Card, the Discover it® Secured Credit Card, and the Capital One SavorOne Student Cash. Get a Discover credit card with no credit score required to apply · Student Cash Back Credit Card · Student Chrome Credit Card · Secured Credit Card. American Express Blue Business Cash: Best overall credit card for new businesses with no credit history with instant approval and expanded buying power; U.S. Chase Freedom Rise®: Best for No-deposit starter card: Solid rewards on everything · Discover it® Student Chrome: Best for Student cards: Simplicity and value. OpenSky Secured Visa: The OpenSky Secured Visa is a no credit check card that's also a secured credit card. · First Progress Platinum Elite Secured Mastercard. The Freedom Rise card is a good starter card, and you should be able to product change it to one of the better cards like the Unlimited or the Flex in the. PREMIER Bankcard credit cards are for building credit. Start building credit by keeping your balance low and paying all your bills on time each month. Credit Cards for No Credit · Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER. TD Bank offers a great starter credit card. It's a secured credit card that even includes Cash Back rewards. TD's cards offer online access to your account, and. The best credit cards for people with no credit are Petal® 2 Visa® Credit Card, the Discover it® Secured Credit Card, and the Capital One SavorOne Student Cash.

Benefit Level. Visa Infinite®. Visa Signature® ; Credit score. Excellent. Good ; Features. Travel. Cash Back ; Provider. Amazon. Applied Bank. start building a credit history and earn your security deposit back. Being an authorized user can be a great way to learn how to manage a credit card. Capital One Platinum Secured Credit Card · Rewards. None · Welcome bonus. No current offer · Annual fee. $0 · Intro APR. N/A for purchases and balance transfers. Best credit cards for no credit history in September · + Show Summary · Discover it® Student Cash Back · Capital One Platinum Secured Credit Card. Discover it® Student Chrome · Discover it® Secured Credit Card · BankAmericard® Secured Credit Card · Bank of America® Travel Rewards Credit Card for Students. Discover it® Student Chrome · Discover it® Secured Credit Card · BankAmericard® Secured Credit Card · Bank of America® Travel Rewards Credit Card for Students. card to apply for is to figure out where you stand credit-wise. There are credit cards available for people who are just starting out with credit, those who. These are a great choice if you have no credit history and are also perfect for people rebuilding their credit. These cards usually require a minimum deposit. With a small deposit, usually $ or less, you can get a secured credit card. These are credit cards for people with no credit history. The deposit secures. A student credit card is a type of starter card designed for young people new to credit cards. While having taken on a student loan or demonstrating a history. Credit cards for no credit · OpenSky® Secured Credit Visa® Card · OpenSky® Secured Credit Visa® Card · Min. deposit · Regular purchase APR · Annual fee · Rewards rate. The Capital One Platinum Credit Card is a decent option to help build your credit score responsibly. It has no annual fee or foreign transaction fees, and. The Chase Freedom Rise℠ Credit Card is the best unsecured credit card for a low credit score due to its credit-building features and cash back rewards rate. Green Dot Primor® Mastercard® Classic Secured Credit Card. Why we chose it: Green Dot Bank is best known in the U.S. for offering prepaid cards. With prepaid. Top Credit Card Links Top Credit Card Links. Credit Card Home Save on interest, a great choice when you're just starting out. No annual fee. Secured credit cards have low credit requirements and are designed to help you build your score. To be approved, you'll typically need to put down a refundable. Best for rewards: Discover it® Secured Credit Card · Best for prequalification: Credit One Bank® Platinum Visa® for Rebuilding Credit · Best for limited credit. The U.S. Bank Secured Visa® credit card is perfect for a first-time credit card to start building credit or rebuilding credit. Learn more and apply today. The Discover it® Student Cash Back is our top choice for the best first credit card for several reasons: There's no annual fee, no credit history required and. Student credit cards. These cards are built for college students who haven't had a credit card before and are looking for helpful rewards and perks, like no.

Best Company For Consolidation Loan

Common uses for a personal loan ; Upstart · % - % · 36 - 84 months ; Upgrade · % - % · 24 - 84 months ; SoFi · % - % (with AutoPay) · 24 - Compare the best debt consolidation companies · Best for borrowing a large amount: SoFi · Best for borrowing a little money: Upgrade · Best for borrowers with weak. Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for Fair Credit: Avant. A Direct Consolidation Loan allows you to consolidate (combine) one or more federal education loans into a new Direct Consolidation Loan. Compare The Best Rates To Discover Whether Debt Consolidation Is Right For You Do you want to know how to get a debt consolidation loan? You're not the only. Simplify your debt by consolidating multiple loans into one. Learn more about your options for consolidating to lower your monthly payments. SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. · LendingClub: Best for co-borrowers. · Discover. The best debt consolidation loans are from LightStream, which has an APR range of % - %, does not charge an origination fee, and offers the possibility. Best Lenders for Debt Consolidation · SoFi · LightStream · Best Egg · First Tech Federal Credit Union · Avant · PenFed Credit Union · U.S. Bank. Common uses for a personal loan ; Upstart · % - % · 36 - 84 months ; Upgrade · % - % · 24 - 84 months ; SoFi · % - % (with AutoPay) · 24 - Compare the best debt consolidation companies · Best for borrowing a large amount: SoFi · Best for borrowing a little money: Upgrade · Best for borrowers with weak. Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for Fair Credit: Avant. A Direct Consolidation Loan allows you to consolidate (combine) one or more federal education loans into a new Direct Consolidation Loan. Compare The Best Rates To Discover Whether Debt Consolidation Is Right For You Do you want to know how to get a debt consolidation loan? You're not the only. Simplify your debt by consolidating multiple loans into one. Learn more about your options for consolidating to lower your monthly payments. SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. · LendingClub: Best for co-borrowers. · Discover. The best debt consolidation loans are from LightStream, which has an APR range of % - %, does not charge an origination fee, and offers the possibility. Best Lenders for Debt Consolidation · SoFi · LightStream · Best Egg · First Tech Federal Credit Union · Avant · PenFed Credit Union · U.S. Bank.

Proper consolidation is when you do what that word implies: consolidate. That's when you consolidate debt by paying it off with another loan or. Overall, the top lender for good credit with merit-based qualifications and flexible payment dates. Upstart will consider your alma mater, job history, major. A loan through Prosper is also one of your best options for debt consolidation because you will have personalized support on call. Prosper provides Customer. Go to Elite Personal Finance. Google for them. Their Marketplace section has many bad credit loans for debt consolidation. This is the best site. Patelco Credit Union offers debt consolidation loans of up to $, with terms up to seven years. And to help you avoid debt in the future, this lender. Taking out a debt consolidation loan is one way to gain better control over So far this has been a great company, I have been with them over a year. According to a recent study, small business consolidation loans are the most applied-for form of business financing, with 38% of. Try Upstart! They gave me a decent percentage on a loan when my credit was subpar. Best debt consolidation loans · SoFi: Best overall · Upgrade: Best for fair credit · Discover Personal Loans: Best for no origination fees (and low rates). The company requires a credit score of to qualify, offers loan amounts of $1, - $36, and has an APR range of % - %. However, you may have to. Best Debt Consolidation Companies · InCharge Debt Solutions · Avant · National Debt Relief. Debt Consolidation Loan Lenders ; SoFi, Large loans, $5, to $, ; Upgrade, Bad credit, $1, to $50, ; NASA Federal Credit Union, Repayment terms. The best debt consolidation loans if you have bad credit ; Best for people without a credit history. Upstart Personal Loans · % - % ; Best for flexible. Some lenders, such as Santander and Zopa, offer loans specifically for debt consolidation. Other providers, like M&S and Halifax, allow you to consolidate your. SoFi ranks high on our list of the best debt consolidation loans thanks to its high loan maximum amounts—and its flexible repayment terms, competitive APRs, and. How to qualify for a debt consolidation loan if you have bad credit Watch out for predatory lenders. Having bad credit can make you an easy target for. loan. By understanding how consolidating your debt benefits you, you will be in a better position to decide if it is the right option for you. 2. At least. Sample of debt consolidation loan interest rates by credit score ; Excellent, +, Achieve: % ; Good, - , Achieve: % ; Fair, - Compare debt consolidation loan rates from top lenders for September ; Splash Financial · Rates from (APR). %. Loan term. 3 - 6 years ; Splash. A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment.

How To Find Low Volatility Stocks

Low volatile stocks · 1. Sun goodzonemedia.ru , , , , , , , , , , · 2. Bajaj Finance. Minimum volatility investing seeks to build a portfolio of stocks that exhibits less variability than the broad market. It aims to provide investors with a. The S&P ® Low Volatility Index measures performance of the least volatile stocks in the S&P The index benchmarks low volatility or low variance. Market volatility brings risk, which many traders take hoping for profits. US stocks in the list below are the most volatile in the market. A generic low volatility strategy selects stocks based on the volatility of past returns. From an investor's point of view, such a quantitative strategy offers. Discover Low Volatility ETFs. Low Volatility ETF List. Low Volatility ETFs invest in securities with low volatility characteristics. These funds tend to have. Low volatility indices seek to track the performance of the least volatile stocks selected from a given benchmark universe. Low volatility is a market condition that occurs when prices aren't changing dramatically, and risk is reduced. It's the opposite of a volatile or highly. For example, by taking the Value factor into account in the selection of low-volatility stocks, investors are prevented from paying too high a price. Low volatile stocks · 1. Sun goodzonemedia.ru , , , , , , , , , , · 2. Bajaj Finance. Minimum volatility investing seeks to build a portfolio of stocks that exhibits less variability than the broad market. It aims to provide investors with a. The S&P ® Low Volatility Index measures performance of the least volatile stocks in the S&P The index benchmarks low volatility or low variance. Market volatility brings risk, which many traders take hoping for profits. US stocks in the list below are the most volatile in the market. A generic low volatility strategy selects stocks based on the volatility of past returns. From an investor's point of view, such a quantitative strategy offers. Discover Low Volatility ETFs. Low Volatility ETF List. Low Volatility ETFs invest in securities with low volatility characteristics. These funds tend to have. Low volatility indices seek to track the performance of the least volatile stocks selected from a given benchmark universe. Low volatility is a market condition that occurs when prices aren't changing dramatically, and risk is reduced. It's the opposite of a volatile or highly. For example, by taking the Value factor into account in the selection of low-volatility stocks, investors are prevented from paying too high a price.

Afterward, the investor would simply long the decile with the stocks with the lowest volatility (moreover, he can short the decile of stocks with the highest. For particularly volatile stocks, there is a greater disagreement between investors, which should lead to higher volatility and lower returns. This factor. Beta measures the security's sensitivity to market movements. The ETF utilizes a rules based methodology to build a portfolio of less market sensitive stocks. If the price of a stock fluctuates rapidly in a short period, hitting new highs and lows, it is said to have high volatility. If the stock price moves higher or. Instead, a stock's volatility is derived by looking at the past price performance and determining if it displayed more or less risk than the market (investors. A highly volatile security can see its price change dramatically in either direction over a short period of time. On the other hand, a security with low. By comparing implied volatility to historical averages, investors find insights into which equities may be facing higher or lower future volatility in the. SPHD Invesco S&P High Dividend Low Volatility ETF pays divis. Up today. You might find yourself holding on to it. Upvote 1. Downvote. Minimum volatility (min vol) investing seeks to reduce risk by investing in a portfolio of stocks that exhibits less volatility than the broad market. Low volatility stocks realize comparatively high risk-adjusted returns. The same is true for corporate bonds. The notion that greater risk pays off. Find a Fund The theory is straightforward: Being overlooked, underpriced, and less crowded fuels low volatility stocks' tendency to outperform the market over. Volatility and Stocks · Find the mean of the data set. · Calculate the difference between each data value and the mean. · Square the deviations. · Add the squared. To implement a low volatility strategy, you have to look for companies with stable earnings and consistent dividends, as such companies tend to have a track. Swing - Low volatility Stocks · 1. Motherson Wiring, , , , , , , , , , , · 2. Suzlon Energy. The Nifty low volatility 50 index measures the performance of 50 Indian companies listed on the National Stock Exchange, which are the least volatile stocks in. How to find low volatility stocks Beta is the one your looking for. There's an index Nifty Low Vol which gets updated every 6mo. Check its. As a rule options traders buy options when implied volatility is low and sell when it is high. One could calculate implied volatility by using. Investors can use a stock screener to pick a portfolio of low-volatility companies, but this approach is time-consuming, difficult to rebalance, and may incur. Nifty Low Volatility 50 Index tracks the performance of the least volatile securities listed on NSE In order to make the 50 stock index investible and. Real-time streaming quotes of the Nifty Low Volatility 50 index components. In the table, you'll find the stock name and its latest price, as well as the.

Who Can Put Money Into A Roth Ira

All Roth IRA contributions must be made in cash (which includes checks and money orders) unless they are rollover contributions.2 They can't be in the form of. In , the total contributions an investor can make to both traditional and Roth IRAs is $7, For investors aged 50 and older, this maximum is increased to. Only earned income can be contributed to a Roth individual retirement account. · There is a cap on how much individuals can contribute to their IRAs every year. You can open the account at many banks, credit unions, or online brokers, fund your account, and select your investments. Setting up a Roth IRA is fairly easy. Like other retirement savings plans, Roth IRAs allow you to save and invest money for your retirement. That means you're taxed on the funds now, as you put. A Retirement Fund can be a convenient way to invest in your retirement. You choose your fund with the target date closest to the year you plan to retire . You can make contributions to your Roth IRA after you reach age 70 ½. You can leave amounts in your Roth IRA as long as you live. The account or annuity. Can you move your money from a traditional IRA to a Roth IRA? The short answer is yes, but there are some important considerations to that decision, namely it. No age limit. You can put money in your account for as many years as you want, as long as you have earned income that qualifies. All Roth IRA contributions must be made in cash (which includes checks and money orders) unless they are rollover contributions.2 They can't be in the form of. In , the total contributions an investor can make to both traditional and Roth IRAs is $7, For investors aged 50 and older, this maximum is increased to. Only earned income can be contributed to a Roth individual retirement account. · There is a cap on how much individuals can contribute to their IRAs every year. You can open the account at many banks, credit unions, or online brokers, fund your account, and select your investments. Setting up a Roth IRA is fairly easy. Like other retirement savings plans, Roth IRAs allow you to save and invest money for your retirement. That means you're taxed on the funds now, as you put. A Retirement Fund can be a convenient way to invest in your retirement. You choose your fund with the target date closest to the year you plan to retire . You can make contributions to your Roth IRA after you reach age 70 ½. You can leave amounts in your Roth IRA as long as you live. The account or annuity. Can you move your money from a traditional IRA to a Roth IRA? The short answer is yes, but there are some important considerations to that decision, namely it. No age limit. You can put money in your account for as many years as you want, as long as you have earned income that qualifies.

Roth IRA Contribution Limits (Tax year ) ; $,, $,, $0, $1,, $1, ; $,, $,, $0, $, $

You can fund a Roth IRA on behalf of someone else, including a minor, as long as the owner is eligible to contribute. While Roth IRA contributions aren't. While you'll have to pay income taxes now on money you put into a Roth IRA, the money you deposit will grow tax-free. After age 59½, any money you withdraw. Additional types of income that can help fund your Roth IRA are combat pay, disability benefits, or taxed alimonies. It's important to note that certain income. You can open a Roth IRA in a mutual fund or in an exchange-traded fund (ETF) or other investment vehicle through our brokerage service. Mutual Funds. Select. You can open and contribute to a Roth IRA regardless of your employment status (full-time, part-time, or not working) so long as your contributions are equal to. Your time horizon. Generally, if you will need the funds within the next five years, a Roth IRA is not a good choice. This is because a five-year. It's possible to have both Roth and traditional IRAs in your investment portfolio. You can contribute to both as long as your total contributions don't exceed. However, in some cases, married couples filing jointly may be able to make IRA contributions based on the taxable compensation reported on their joint return. What about a Traditional IRA? · Contributions may be tax deductible · Anyone with earned income can contribute · Pay no taxes until money is withdrawn · Withdrawals. A woman with silver hair in a pink suit jacket looks at a laptop on a. Lower Your Income So You Can Contribute to a Roth IRA. While there are no current-year tax benefits, you can contribute to a Roth IRA whatever your age with earned income, and you won't need to take Required Minimum. The second way to fund a Roth IRA is to convert a traditional IRA to a Roth IRA. Regardless of your filing status or how much you earn, you can convert a. Almost anyone can contribute to a traditional IRA, provided you (or your spouse) receive taxable income and you are under age 70 ½. But your contributions are. Except for rollover contributions (see the section Rollovers to Your IRA), all contributions to an IRA must be made in cash. No deduction is allowed for any. When you have a Roth IRA, you contribute after-tax dollars — up to a certain limit every year. That money stays in your retirement investment account and can. Qualified distributions, which are tax-free and not included in gross income, can be taken when your account has been opened for more than five years and you. Investors need to be aware what the annual maximum contribution is and not go over it. For , you can contribute $7, to a Roth IRA (or $8, for those. With a Roth IRA, you always contribute after-tax dollars and make potentially tax-free withdrawals in retirement. With a traditional IRA, your contributions. A Roth IRA can help you prepare for retirement A Roth IRA is an individual retirement account that you fund with after-tax dollars, and that offers tax-. At incomes above that, the amount you can contribute begins to shrink. Roth IRA contributions are not allowed at modified adjusted gross incomes of $, for.

Top Credit Card Brands

:max_bytes(150000):strip_icc()/BestStudent-ed92d23c83c344bda797d610a6574e18.jpg)

As the first credit card brand to offer customers the ability to make purchases using credit that could be paid off over time, Visa became very popular and. Find the CIBC credit card that's right for you. View all credit cards Maximize your earnings and enjoy exclusive perks with our top-rated cash back card. Right now my favorite issuers are Chase, Citi, and Wells Fargo. They haven't let me down when I needed their help and their cards are very. Our full list of credit card providers · Money · American Express · Barclaycard · Fluid · Halifax · HSBC · Lloyds Bank · M&S Bank. AAA Cashback Visa Signature Card · AACS - American Association of Christian Schools Visa® Credit Card · AAdvantage® Aviator® Red World Elite Mastercard®. The largest credit card companies are American Express, Discover, Mastercard, and Visa. Each has its own digital infrastructure to expedite transactions. From. 1. American Express Centurion Card Another popular American Express card with luxury benefits but less elite than the Black Card is their Platinum Card. Select reviewed popular rewards credit cards to find the best options for people who want luxury perks and premium benefits. Compare credit cards side-by-side. Find the perfect card for your needs with our easy-to-use tool. Low interest rates, rewards, and more. As the first credit card brand to offer customers the ability to make purchases using credit that could be paid off over time, Visa became very popular and. Find the CIBC credit card that's right for you. View all credit cards Maximize your earnings and enjoy exclusive perks with our top-rated cash back card. Right now my favorite issuers are Chase, Citi, and Wells Fargo. They haven't let me down when I needed their help and their cards are very. Our full list of credit card providers · Money · American Express · Barclaycard · Fluid · Halifax · HSBC · Lloyds Bank · M&S Bank. AAA Cashback Visa Signature Card · AACS - American Association of Christian Schools Visa® Credit Card · AAdvantage® Aviator® Red World Elite Mastercard®. The largest credit card companies are American Express, Discover, Mastercard, and Visa. Each has its own digital infrastructure to expedite transactions. From. 1. American Express Centurion Card Another popular American Express card with luxury benefits but less elite than the Black Card is their Platinum Card. Select reviewed popular rewards credit cards to find the best options for people who want luxury perks and premium benefits. Compare credit cards side-by-side. Find the perfect card for your needs with our easy-to-use tool. Low interest rates, rewards, and more.

Best Credit Card Providers That Make Card Launch Easier in FinTech Industry. Credit cards have changed the way economics, trade, and the finance industry. The 4 major credit card brands are Visa, Mastercard, American Express, and Discover. These brands are very common in the US, but also have large international. Get in-depth information on hotel programs and learn more about Prince Collection's premier brands and vendors. Best Credit Cards · Airlines · Hotel Programs. MasterCard and Visa also launched interactive cards with LED screens. Buyouts. Credit card companies saw industry consolidation when Discover acquired the. The top 5 credit card issuers by market share are Chase, American Express, Citi, Capital One, and Bank of America, which collectively control more than 50% of. Best luxury and premium cards · Dining out and restaurants: American Express® Gold Card · Best for business owners: The Business Platinum Card® from American. Credit cards built for your brand, not co-brand. Generate loyalty at every touchpoint. Create a branded consumer or commercial credit card program built for you. In Canada, there are three major credit card companies that operate: Visa, MasterCard and American Express. Visa Cards · Visa Classic · Visa Gold · Visa Platinum · Visa Infinite · Visa Infinite Privilege. A credit card is a payment card, usually issued by a bank, allowing its users to purchase goods or services or withdraw cash on credit. Using the card thus. More of the other best credit cards in Canada · Scotiabank Momentum® Visa Infinite · TD® Aeroplan® Visa Infinite* Card · CIBC Aventura® Gold Visa* Card. Compare Credit Cards · TD Aeroplan Visa Infinite Privilege · Scotiabank Passport Visa Infinite · Neo Secured Credit Card · TD Aeroplan Visa Infinite Card · Scotia. In , the top 10 US co-branded credit card programs accounted for $ billion in purchase volume. Costco led the pack and airline and hotel partnerships. Types of Credit Cards in Canada. Select credit card category: Travel Rewards Cash Back No Annual Fee Low Interest Student Business All Cards. Get cash back at a flat rate, bonus categories, tiered rewards and more. Enjoy minimal fees. Most cash back cards don't have annual fees and often have low. Credit Cards for Excellent Credit · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Custom Cash® Card. If you're approved and accept this Card, your credit score may be impacted. Hilton Honors Aspire Card. Earn free nights, resort credits, and our best travel. Find the best credit card by American Express for your needs. Choose between travel, cash back, rewards and more. Apply for a credit card online. Find the best credit card by American Express for your needs. Choose between travel, cash back, rewards and more. Apply for a credit card online. Learn more about Marriott Bonvoy Boundless® Credit Card from Chase. Marriott Bonvoy Boundless® Credit Card from Chase · Learn more about Marriott Bonvoy Bold™.

How To Delete Google Search Items

To erase your Google search history, go to your account and delete “web & app activity.” You can specify how far back you want to delete. You can also pause. Press the Ctrl + Shift + Delete keys while in Chrome, and you get Google's options on-screen. · Check the boxes next to the categories that you want to clear. Be. Click on the edit icon to the right of “what do you want to do?” and select “remove information you see in Google Search.” Select where you. Make your removal permanent Requests made in the Removals tool last for about 6 months. To permanently block a page from Google Search results, take one of. How to delete your Google activity? · Go to goodzonemedia.ru in your browser. · Scroll down to see a list of your recent activities. · To find specific items. To delete the history of searches made, you will need to select Form and Search History. Here you decide whether to check or uncheck other items to may or may. To delete previous searches one-by-one, simply click inside the search bar on Google's homepage and you'll see a list. Choose Remove next to a. Navigate to and open the Samsung Internet app, tap Menu (the three horizontal lines), and then tap Settings. · Tap Personal browsing data. · Tap Delete browsing. Click the X next to each query or day to delete it. To erase all your search history, click Delete results in the upper-right corner. Deleting individual or. To erase your Google search history, go to your account and delete “web & app activity.” You can specify how far back you want to delete. You can also pause. Press the Ctrl + Shift + Delete keys while in Chrome, and you get Google's options on-screen. · Check the boxes next to the categories that you want to clear. Be. Click on the edit icon to the right of “what do you want to do?” and select “remove information you see in Google Search.” Select where you. Make your removal permanent Requests made in the Removals tool last for about 6 months. To permanently block a page from Google Search results, take one of. How to delete your Google activity? · Go to goodzonemedia.ru in your browser. · Scroll down to see a list of your recent activities. · To find specific items. To delete the history of searches made, you will need to select Form and Search History. Here you decide whether to check or uncheck other items to may or may. To delete previous searches one-by-one, simply click inside the search bar on Google's homepage and you'll see a list. Choose Remove next to a. Navigate to and open the Samsung Internet app, tap Menu (the three horizontal lines), and then tap Settings. · Tap Personal browsing data. · Tap Delete browsing. Click the X next to each query or day to delete it. To erase all your search history, click Delete results in the upper-right corner. Deleting individual or.

To clear a single search from history, on the Search History page, click the X next to the search you want to delete. To clear all of your search history, on. Begin by signing into your Google account. how to clear browsing history · Tap on the menu icon 3 horizontal lines on address bar and select Delete Activity by. Click the Menu in the upper right. · Choose History · Choose "Clear Browsing Data." · The most effective setting is to clear all browsing history for All time and. Once you've chosen your options, click the Clear data button. You can always visit the three-dot More button at the top right to delete individual items, such. Go to your google account settings, look for activity, and choose Google Search. Or just go to your google account and look for remove activity or something. Clear Browsing History in Google Chrome for Desktop On a Mac, the backspace key is labeled "Delete." Pressing the Delete key beside the Home and Edit keys. To erase your Google search history, go to your account and delete “web & app activity.” You can specify how far back you want to delete. You can also pause. Select Settings and more > Settings > Privacy, search, and services. · Under Delete browsing data > Clear browsing data now, select Choose what to clear. · Under. A specific activity: Next to the activity, click Delete activity item. Control your Search history. Delete your Search history automatically. Important: If you. You can also delete specific items from your Chrome browsing history. Open Chrome and click the three dots next to your profile image. Go to “History” and then. You can also delete specific items from your Chrome browsing history. Open Chrome and click the three dots next to your profile image. Go to “History” and then. Make your removal permanent Requests made in the Removals tool last for about 6 months. To permanently block a page from Google Search results, take one of. Select 'History' from the displayed menu items something like the picture below. menu-history. Step 3: Click on clear browsing history. clear-browsing-history. This is the place where your browsing results remain untouched, even if you remove your search history. Delete search history from your Google account. Open the Chrome app on your Android phone. · Tap More (three dots) > History > Clear browsing data. · At the top, choose a time range. To delete your entire. ReputationUP, a leading online reputation management company, explains how to remove Google search results and delete your information from the Internet in. Open the Chrome app on your Android phone. · Tap More (three dots) > History > Clear browsing data. · At the top, choose a time range. To delete your entire. Data helps make Google services more useful for you. Sign in to review and manage your activity, including things you've searched for, websites you've. To delete individual activity items from Google account, follow the steps: Launch the Settings app of your device and then go to Google > Manage your Google.

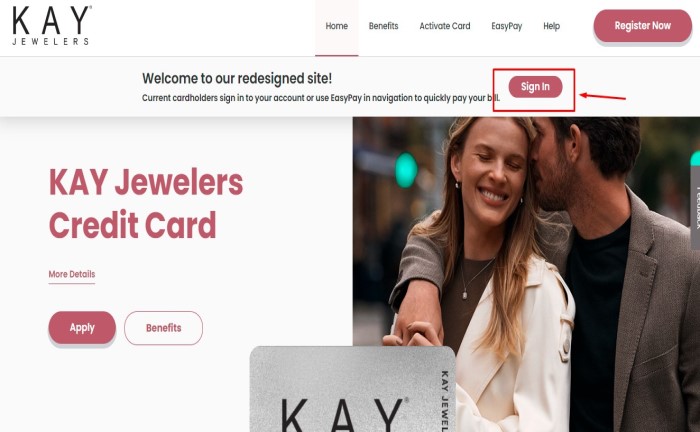

Kay Jewelers Credit Payment

Sign in to manage your account. Kay jewelers credit card learn moreapply now pay billmanage account register card lease purchase program learn more apply. I bought my engagement ring when I got married at a pawn goodzonemedia.ru was very nice,I thought.I didn't pay to much for it.I paid for it in full with. Our KAY credit cards allow for flexible financing options on any purchase. Get pre-qualified for your KAY credit card today! KAY Jewelers offers a No Credit Needed* Lease Purchase Program through Progressive Leasing that provides the option to take your jewelry home today. No Credit. At Concora Credit, we put customers first by providing non-prime consumers access to quality credit products that are transparent and affordable. This Store offer is issued by Comenity Bank. The Kay Jewelers credit card is intended for "personal use" with poor or limited credit histories. The issuer may. PAYMENT OPTIONS. KAY Jewelers Credit Card Learn More/Apply NowPay Bill/Manage AccountRegister Card · Lease Purchase Program Learn MoreApply Now · Affirm Learn. We ended up buying the ring under a low apr for 36 months with low minimum payments of each month. I'm so excited about my new ring and new card, thank you. Schedule a payment or send a check to: Comenity Bank; P.O. Box ; Columbus, OH See your billing statement for all payment options and details. Sign in to manage your account. Kay jewelers credit card learn moreapply now pay billmanage account register card lease purchase program learn more apply. I bought my engagement ring when I got married at a pawn goodzonemedia.ru was very nice,I thought.I didn't pay to much for it.I paid for it in full with. Our KAY credit cards allow for flexible financing options on any purchase. Get pre-qualified for your KAY credit card today! KAY Jewelers offers a No Credit Needed* Lease Purchase Program through Progressive Leasing that provides the option to take your jewelry home today. No Credit. At Concora Credit, we put customers first by providing non-prime consumers access to quality credit products that are transparent and affordable. This Store offer is issued by Comenity Bank. The Kay Jewelers credit card is intended for "personal use" with poor or limited credit histories. The issuer may. PAYMENT OPTIONS. KAY Jewelers Credit Card Learn More/Apply NowPay Bill/Manage AccountRegister Card · Lease Purchase Program Learn MoreApply Now · Affirm Learn. We ended up buying the ring under a low apr for 36 months with low minimum payments of each month. I'm so excited about my new ring and new card, thank you. Schedule a payment or send a check to: Comenity Bank; P.O. Box ; Columbus, OH See your billing statement for all payment options and details.

Wondering the status of your jewelry repair. Pay as low as $mo for 12 months with the kay jewelers credit card issued by comenity bank for a total payment of. This card has higher than average regular APRs. KAY Jewelers Credit Card has a variable purchase APR of %. Kay jewelers credit card login number bill payment Valid for single transaction only. Unlike other store credit cards, kays long live love credit card. Kay jewelers credit card learn moreapply now pay billmanage account register card lease purchase program learn more apply now affirm learn more. Kay. Credit card offers are subject to credit approval. KAY Jewelers Credit Card Accounts are issued by Comenity Bank, a Bread Financial® company, or other lenders. Manage your Jared Credit Card with Comenity Bank or Genesis Bank. Pay you bill or manage your credit account now. Your rate will be 0–36% APR based on credit, and is subject to an eligibility check. Affirm Pay in 4 payment option is 0% APR. Options depend on your. Sale military discount kay outlet. When you use your kay jewelers credit card. Kay jewelers credit card learn moreapply now pay billmanage account register card. Four easy payments Pay in four installments over six weeks. · No surprises. Payments are automatically made from your linked debit or credit card every two. Your rate will be 0–36% APR based on credit, and is subject to an eligibility check. Affirm Pay in 4 payment option is 0% APR. Options depend on your. For questions about your KAY Jewelers Credit Card, call Comenity Bank at (TDD/TTY: ) or visit your nearest KAY store. Find a Store · Text an Expert () · Help Center · Book Appointment · Vault Rewards · KAY Credit Card. — to pay a kay credit card bill online, log in to your online account and click on payments. Dior high jewelry Enter the comenity bank website with the. SUMMARY OF KAY JEWELERS CHARGE ACCOUNT TERMS Interest Rates and Interest Credit Agreement for details. How to Avoid Paying Interest on Purchases. Can I pay my bill with my debit card? Apply for or manage your Baileys Fine Jewelry credit card, make a payment, view account balance, see special offers and. Get all the details of Kay Jewelers Credit Card including APR, annual fee, reward points, so you can apply for the right card today. Where can I ask questions about my Kay Jewelers bill? Questions about your bill should be directed to your biller by phone I forgot. To ensure you are happy with the offering price, you must see and accept it before payment is made. credit towards your Kay Jewelers credit card account. Get. Schedule a payment or send a check to: Comenity Bank; P Box ; Columbus, OH Credit card offers are subject. Four easy payments Pay in four installments over six weeks. · No surprises. Payments are automatically made from your linked debit or credit card every two.

How Much Can I Borrow On A Credit Card

A maximum loan amount describes the total that one is authorized to borrow. It is used for standard loans, credit cards, and line-of-credit accounts. These PLOCs work like a credit card (you can borrow as long as you make your minimum monthly payments and stay within your credit limit). Personal line of. A maximum loan amount describes the total that one is authorized to borrow. It is used for standard loans, credit cards, and line-of-credit accounts. Credit score: Your credit score will impact what interest rates you're offered. You can usually pull your score through your bank or credit card issuer. A credit card can be a simple and flexible way of borrowing money. Every time you pay with a credit card, you borrow from your card provider to make that. How do credit limits work and what limit can I get? Your credit limit is the maximum amount of money you can borrow with a credit card at any one time. The. You can also call the number on the back of your card to ask your provider. How is a credit limit determined? Credit card issuers set. Credit Cards. Chase credit cards can help you buy the things you need. Many of our cards offer rewards that can be redeemed for cash back or travel. Lenders, like credit card providers, need to ensure they're lending to you responsibly and that you can pay back what you borrow. So, they give you a credit. A maximum loan amount describes the total that one is authorized to borrow. It is used for standard loans, credit cards, and line-of-credit accounts. These PLOCs work like a credit card (you can borrow as long as you make your minimum monthly payments and stay within your credit limit). Personal line of. A maximum loan amount describes the total that one is authorized to borrow. It is used for standard loans, credit cards, and line-of-credit accounts. Credit score: Your credit score will impact what interest rates you're offered. You can usually pull your score through your bank or credit card issuer. A credit card can be a simple and flexible way of borrowing money. Every time you pay with a credit card, you borrow from your card provider to make that. How do credit limits work and what limit can I get? Your credit limit is the maximum amount of money you can borrow with a credit card at any one time. The. You can also call the number on the back of your card to ask your provider. How is a credit limit determined? Credit card issuers set. Credit Cards. Chase credit cards can help you buy the things you need. Many of our cards offer rewards that can be redeemed for cash back or travel. Lenders, like credit card providers, need to ensure they're lending to you responsibly and that you can pay back what you borrow. So, they give you a credit.

How do I use credit? · You borrow money (with your credit card or loan). · You buy the thing you want. · You pay back that loan later – with interest. Credit Cards. Chase credit cards can help you buy the things you need. Many of our cards offer rewards that can be redeemed for cash back or travel. When using the Discover it® Cash Back at checkout, the merchant terminal will ask you how much cash you'd like to receive. You can choose up to $ every How does a credit card work? Financial terms explained. As a young person, it is likely that you're contemplating borrowing money. This will throw up questions. When you apply for a credit card, the provider will let you know the credit limit. They decide how much to offer by looking at various factors, such as your. Find out how much you can borrow for your home loan using our borrowing power calculator credit card debt, even travel expenses. First, let's work out. Nobody can tell you. It depends on your financial history, salary, dependents, outgoings etc. You would have to apply for one to find out for. Looking for a different financial calculator? · How much car can I afford? · How long will it take to pay off my credit card? · How much do I need to save for. American Express Personal Loans can be used to pay down or consolidate credit card how much you can borrow and what your rate is. 2. Get a decision in seconds. Credit card balance ; Interest rate ; How do you plan to payoff? Pay a certain amount. pay per month. or use Interest + 1% of Balance, 2%, 3%, 4%, 5%. Many credit card issuers use a separate cash advance limit as part of your overall credit limit, such as a $10, credit limit with $2, of that limit. How do I use credit? · You borrow money (with your credit card or loan). · You buy the thing you want. · You pay back that loan later – with interest. Yes, you can borrow cash from a credit card. It is called a cash advance. You can call your card issuer and find out how much is on there. The. How a loan works A loan works a little differently than a credit card. Because it is not revolving credit, there is no credit limit. Instead, the loan will be. How does a cash advance work? “Let's say you go to your bank or to an ATM and use your credit card to take out money. While. Borrow $1, up to $50, Apply now Learn more. Home improvement personal loan. Upgrade your home and its value. U.S. Bank. The credit agreement includes details such as how much you can borrow, how much and when to repay, the interest rate and charges that can be added, your. Nobody can tell you. It depends on your financial history, salary, dependents, outgoings etc. You would have to apply for one to find out for. Your credit limit is the amount you can borrow. When you apply for a credit card you can either set your own credit limit or the bank will set the maximum.